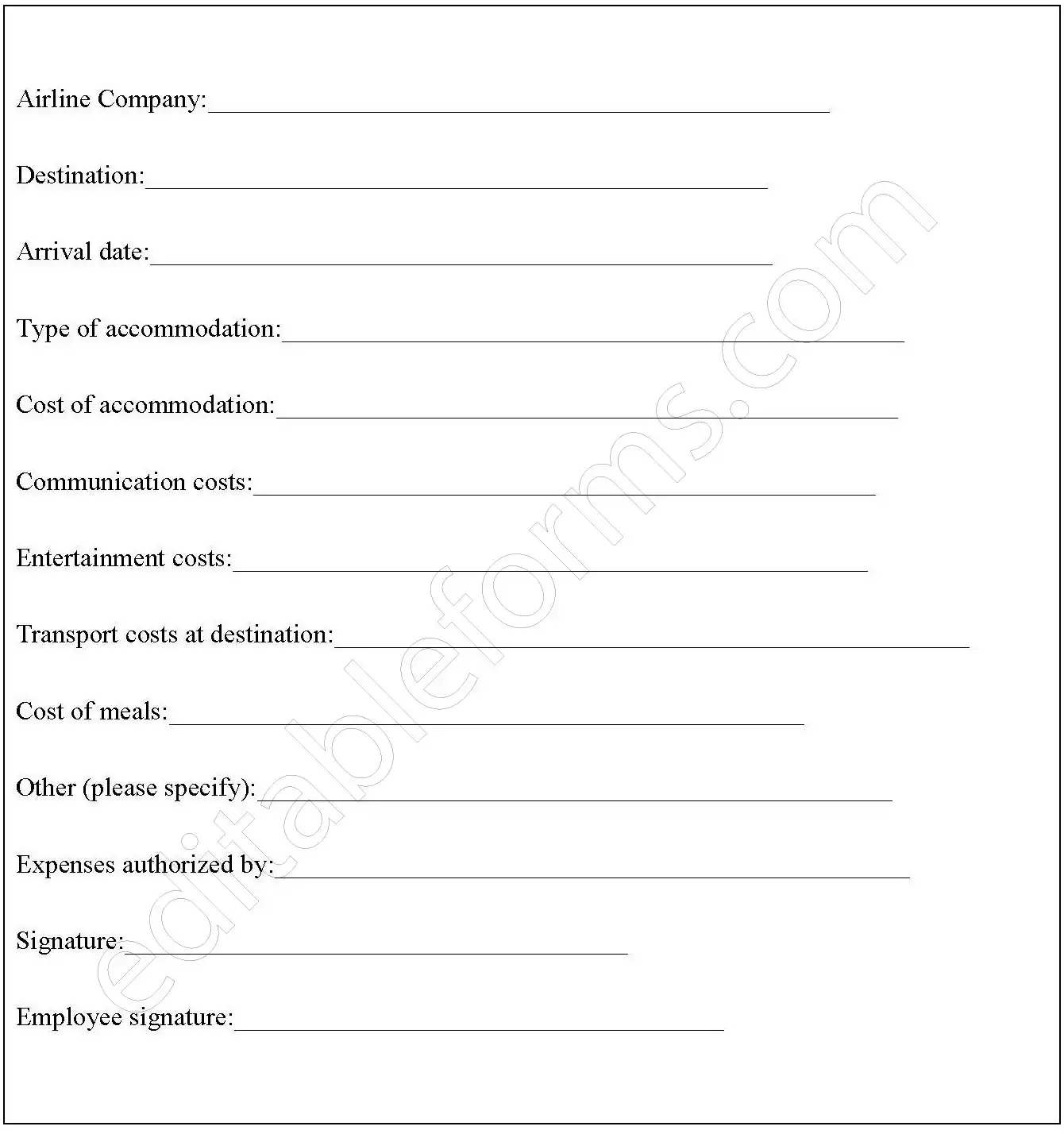

A travel expense form template can be used as an example of the format used in such a document. It outlines the type of questions that should be used to gain required information. The aim is to find out costs incurred by an employee while traveling, say on a business trip.

You can Download the Travel Expense Form Template, customize it according to your needs, and Print it.Travel Expense Form Template is either in MS Word or Editable PDF.

Download the Travel Expense Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Employee Information:

Collects basic details like the employee’s name, job title, department, and also contact information.

Trip Details:

Asks for the reason for travel, the destination, and also the dates of the trip.

Travel Expenses:

Includes sections to record expenses for:

Transportation: Airfare, train tickets, bus tickets, car rentals, and taxi fares.

Lodging: Hotel or accommodation costs.

Meals and Entertainment: Expenses for meals, snacks, and also entertainment related to business activities.

Other Expenses: Any other miscellaneous expenses incurred during the trip.

Receipts:

Requires the submission of original receipts to support each expense claim.

Signature and Approval:

Requires the employee’s signature and also the approval of their supervisor or manager.

Benefits

Standardization:

Ensures consistency in the process of submitting and also processing travel expense claims.

Clarity:

Clearly outlines the information required to process reimbursement claims.

Efficiency:

Streamlines the reimbursement process by providing a structured format.

Accuracy:

Reduces the risk of errors in calculating reimbursement amounts.

Record Keeping:

Serves as a valuable record of travel expenses, which can be important for tax purposes and also expense reporting.

Compliance:

Helps organizations comply with expense reimbursement policies and also tax regulations.

Employee Satisfaction:

Provides a clear and efficient process for employees to claim reimbursement for business-related expenses.