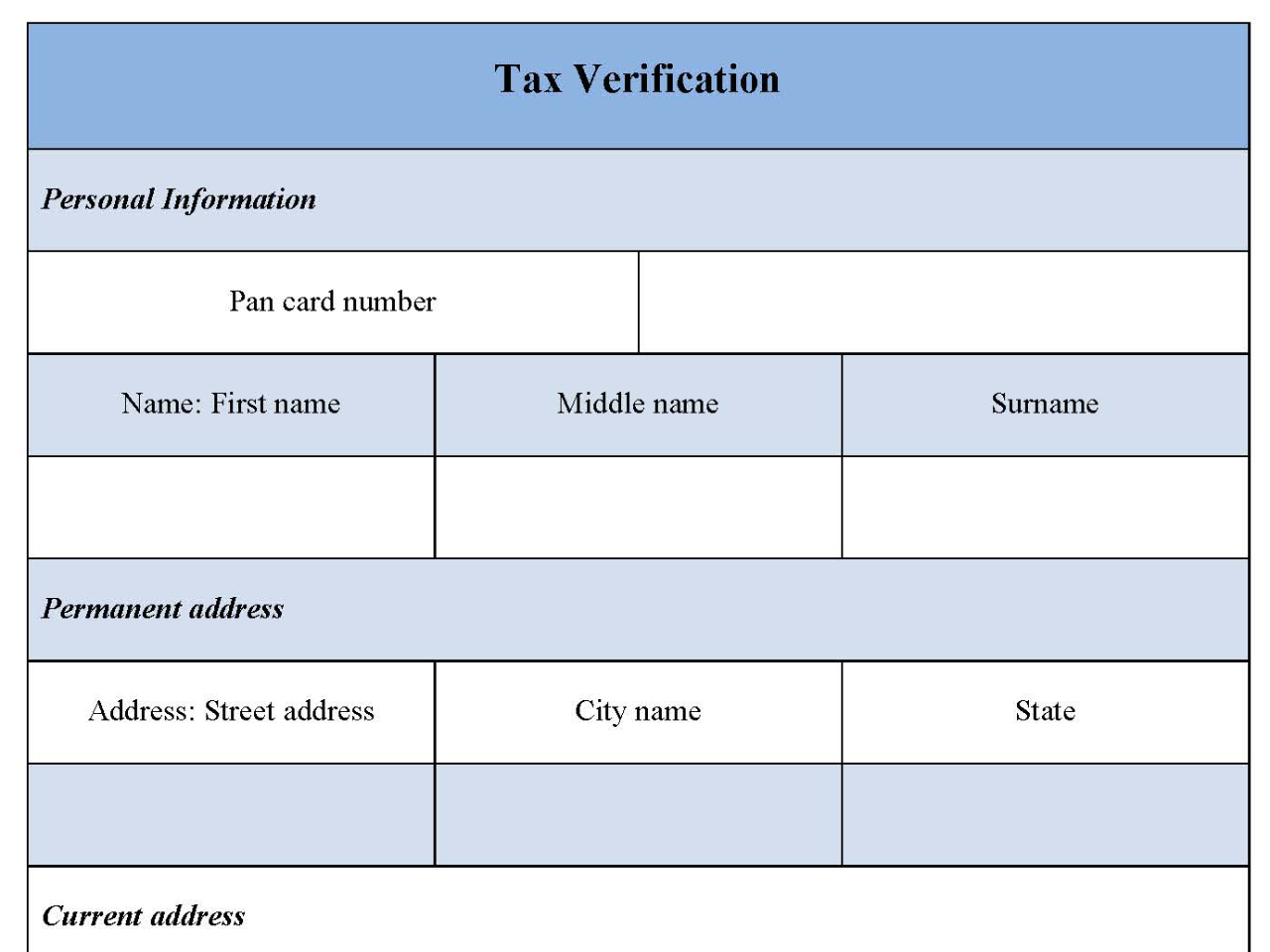

A tax verification form is a document which an individual needs to fill up whenever he files for tax return. The form has details like the income of the person and amount of tax payable, based on which the tax return is calculated.

You can Download the Tax Verification Template, customize it according to your needs, and Print it. Tax Verification Template is either in MS Word or Editable PDF.

Download the Tax Verification Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Features:

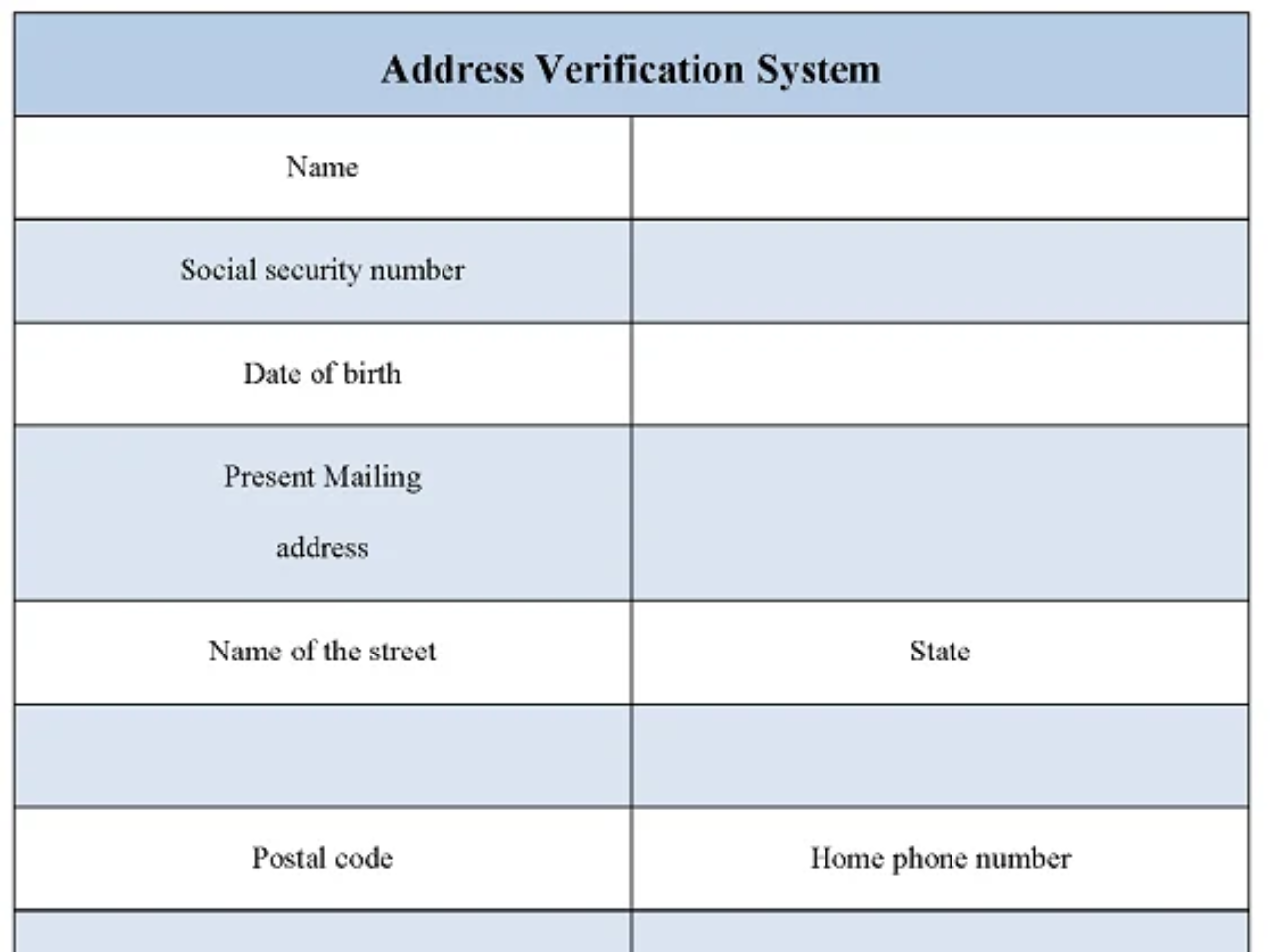

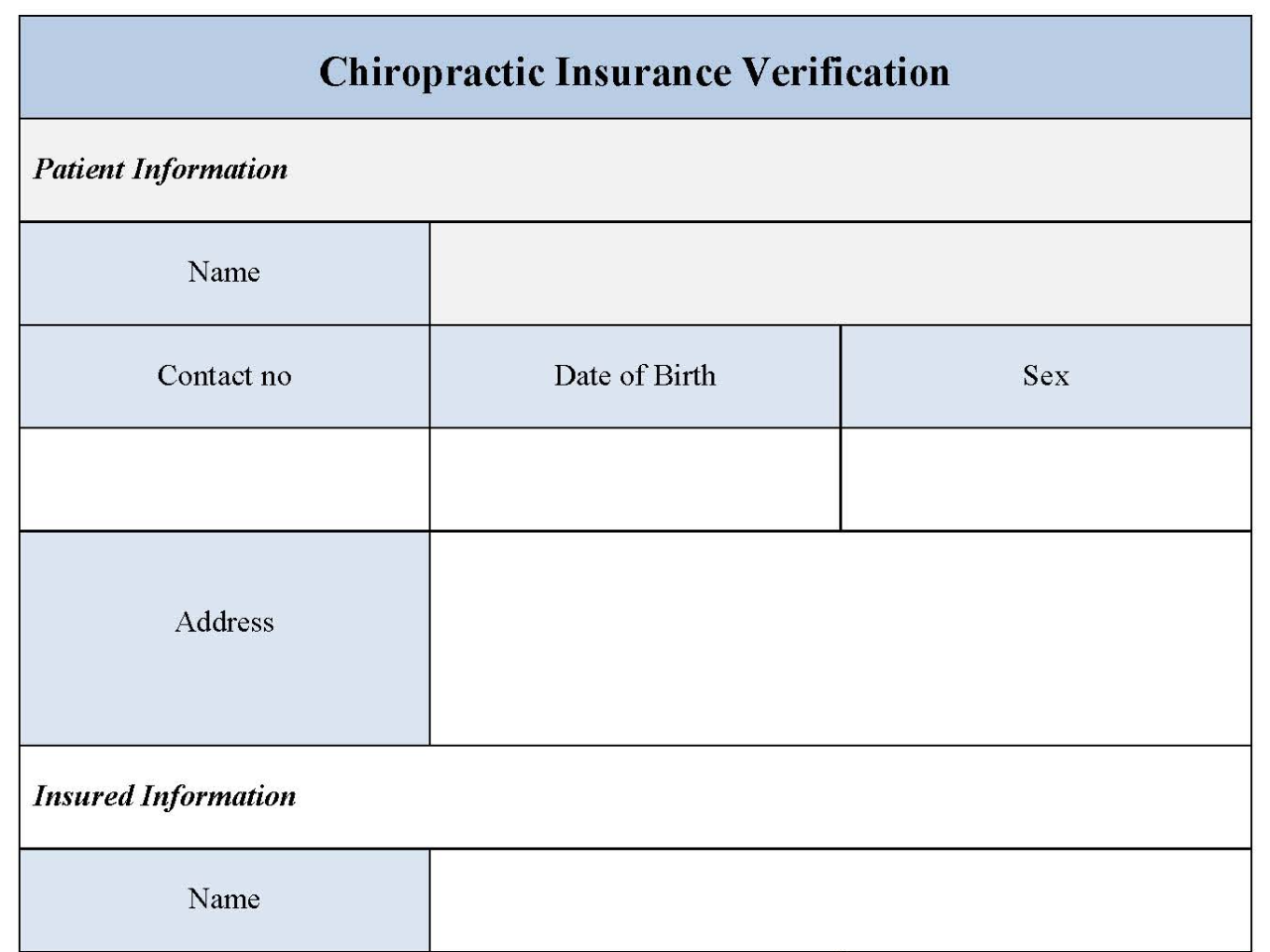

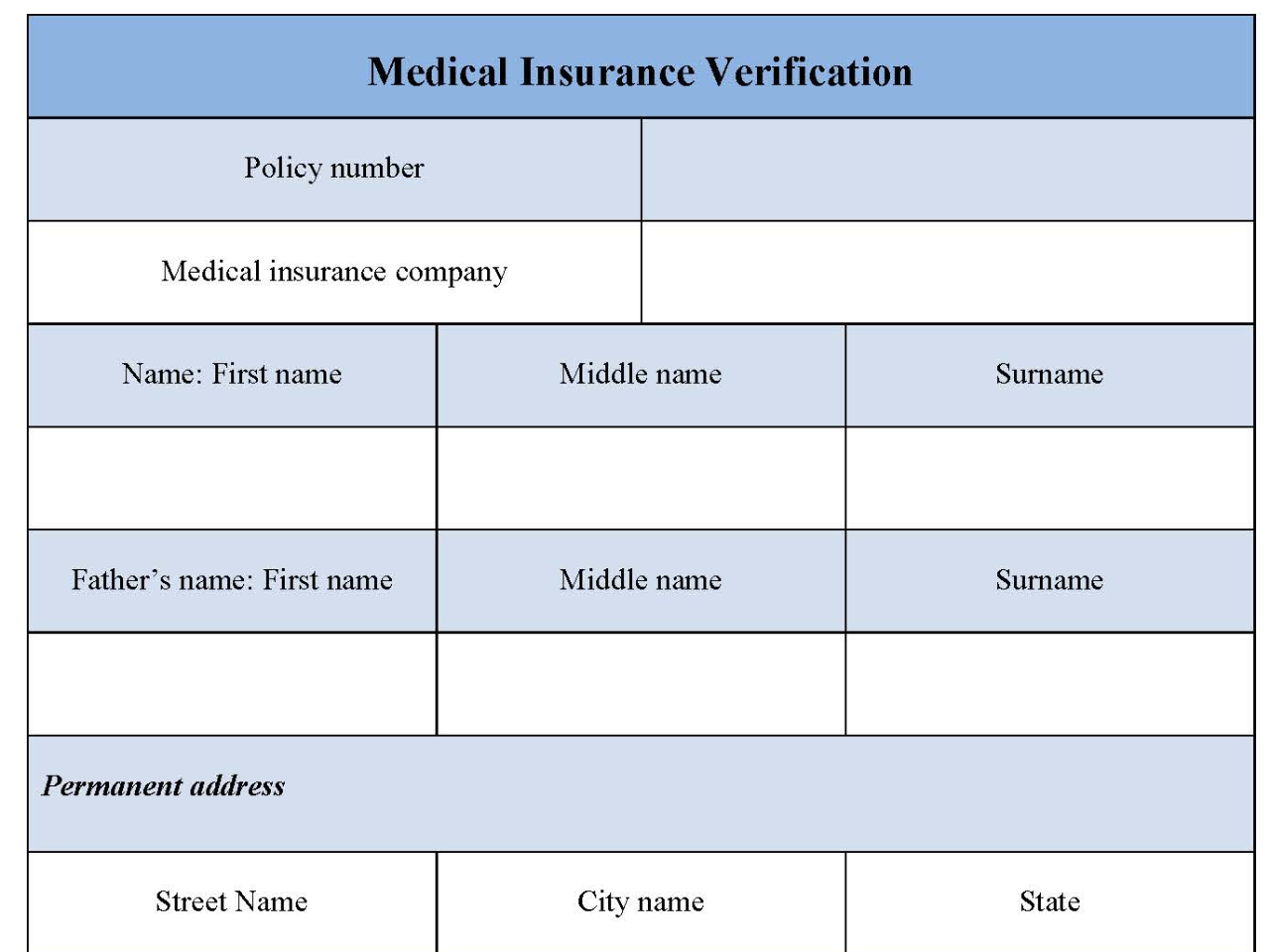

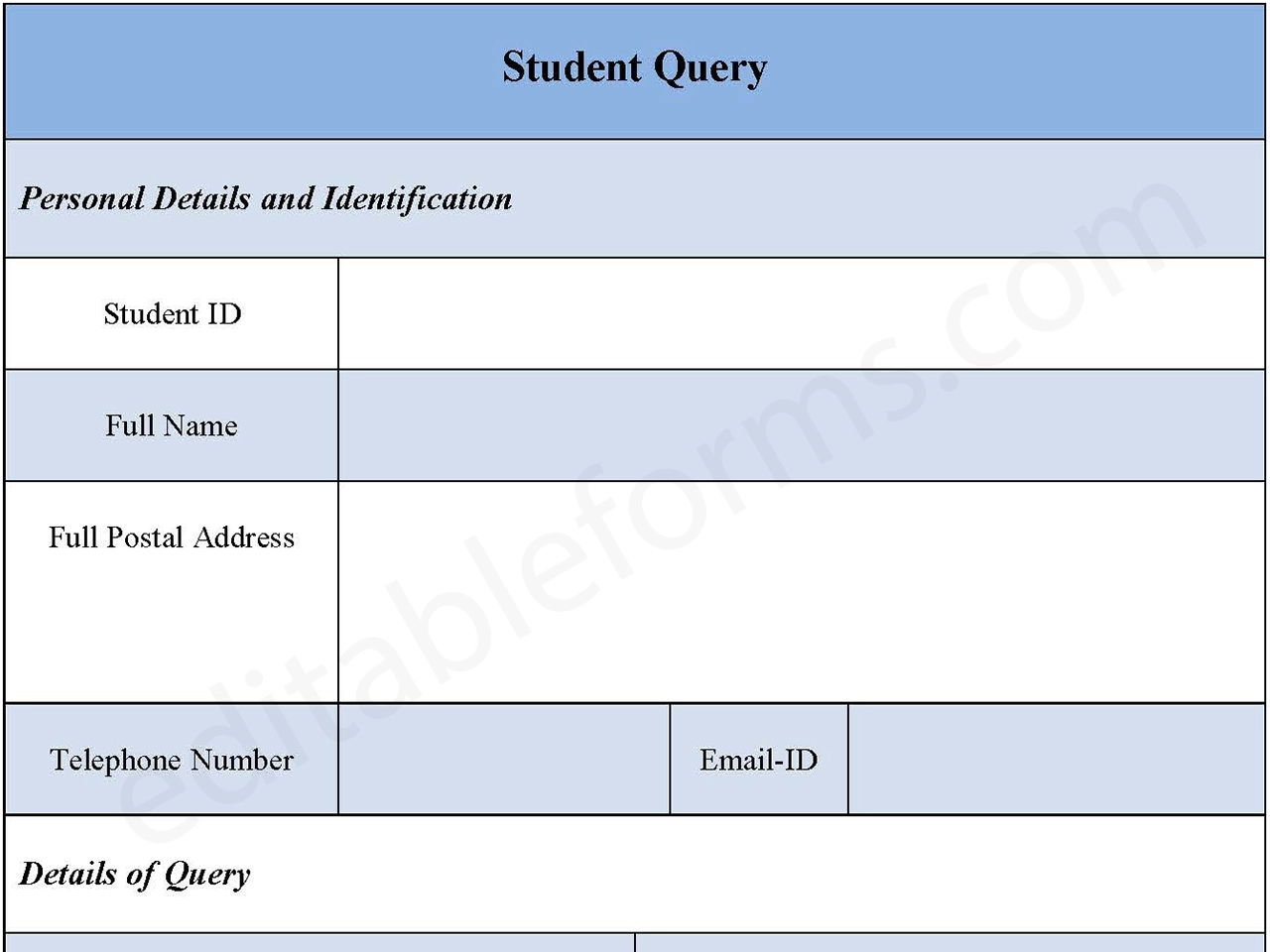

Taxpayer Information:

Captures basic details like name, tax identification number (TIN), and contact information.

Tax Period:

Specifies the tax year or period for which verification is requested (e.g., income year, sales tax quarter).

Tax Type: Identifies the specific tax being verified (e.g., income tax, sales tax, property tax).

Verification Purpose:

Allows the taxpayer to indicate the reason for requesting verification, such as loan application, employment verification, or government benefit eligibility.

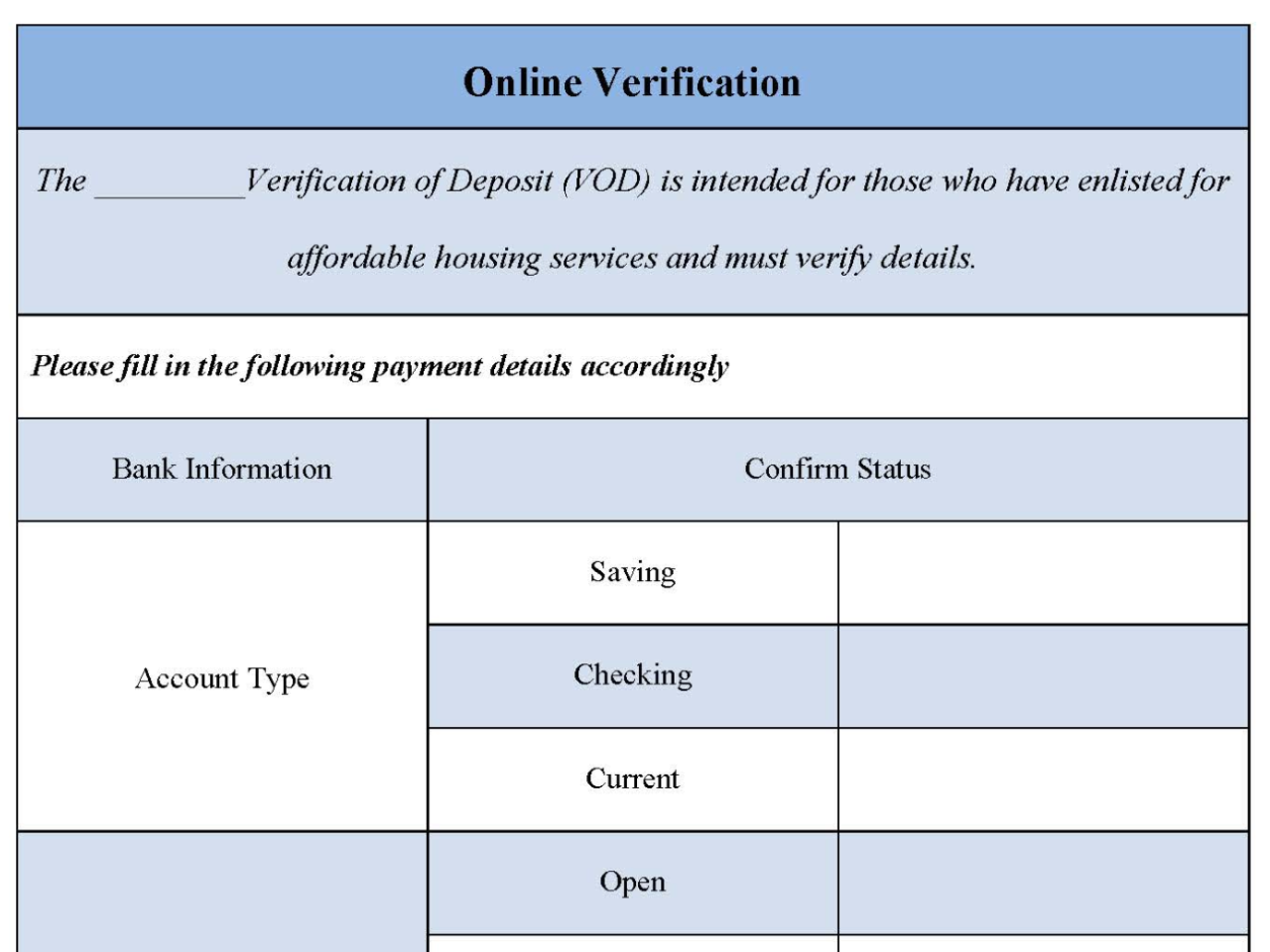

Tax Details:

May include sections for outlining taxable income, taxes paid, deductions claimed, or other relevant tax information depending on the type of tax.

Verification Options:

May offer options to choose how the recipient should verify the information (e.g., online access, phone call, mailed verification letter).

Security Features:

May have built-in security measures to protect sensitive tax information, such as password protection or encryption.

Digital Format:

Online or digital forms can facilitate easier submission and processing.

Benefits:

Simplified verification process:

Provides a standardized format for taxpayers to request tax verification, streamlining the process for both taxpayers and recipients.

Faster turnaround:

Digital forms can expedite the verification process compared to traditional paper methods.

Improved accuracy:

Pre-populated information from tax returns (where applicable) can help reduce errors in manual data entry.

Enhanced security:

Digital forms with security features can help protect sensitive tax information during transmission.

Convenience:

Taxpayers can submit verification requests electronically from anywhere with an internet connection.

Transparency:

Verification forms can provide recipients with a clear picture of the taxpayer’s tax history.