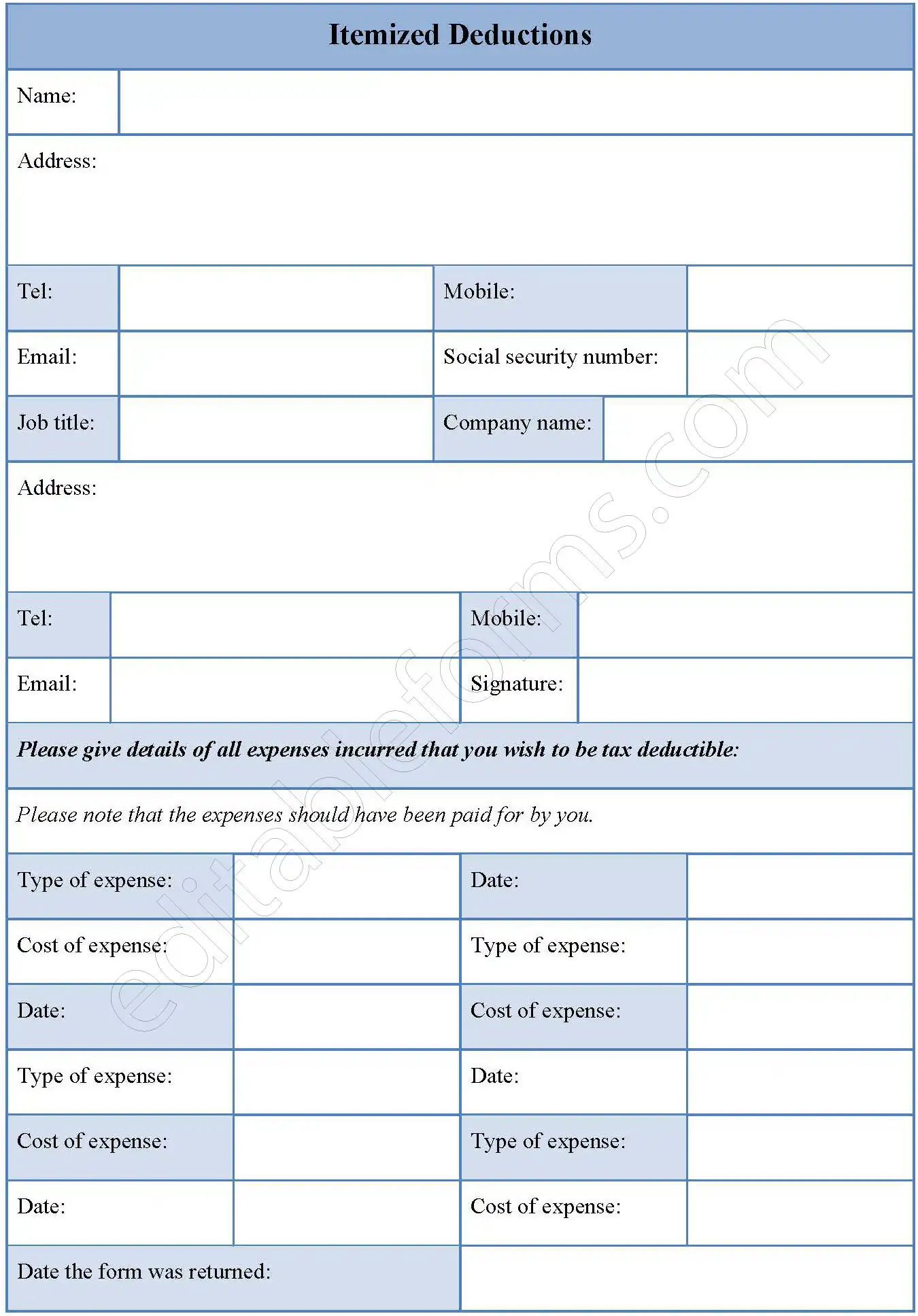

An itemized deductions form is used for tax purposes. The format of this form enables an individual to fill out all expenses incurred within a given period in order for them to be tax deductible. All information given for purposes of deductions has to be accurate, completely honest and verifiable.

You can Download the Itemized Deductions Form Template, customize it according to your needs, and Print it. Itemized Deductions Form Template is either in MS Word or Editable PDF.

Download the Itemized Deductions Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Comprehensive Categories:

form typically includes comprehensive categories for tracking itemized deductions, such as medical expenses, mortgage interest, charitable donations, and also business expenses.

Detailed Fields:

The form includes detailed fields for recording specific information, such as dates, amounts, and descriptions, to ensure accurate and also complete tracking of deductions.

Calculation Fields:

The form often includes calculation fields to help users calculate the total amount of deductions, making it easier to claim the correct amount on their tax return.

Customizable:

The form can be customized to fit the specific needs of the user, including adding or removing categories, fields, or sections as required.

Integration with Tax Software:

The form can be integrated with tax software, making it easy to import data and generate accurate tax returns.

Benefits:

Maximize Deductions:

The Itemized Deductions Form helps users maximize their deductions, ensuring they claim the correct amount and reduce their tax liability.

Accurate Record-Keeping:

The form provides a structured and organized way to track deductions, reducing errors and also ensuring accurate record-keeping.

Simplified Tax Preparation:

The form simplifies the tax preparation process by providing a clear and comprehensive record of deductions, making it easier to complete tax returns.

Increased Efficiency:

The form streamlines the process of tracking and claiming deductions, saving time and also reducing administrative burdens.

Reduced Audit Risk:

By accurately tracking and claiming deductions, users can reduce the risk of audit and also potential penalties.

Improved Financial Planning:

The form provides a clear picture of expenses and deductions, enabling users to make informed financial decisions and also plan for the future.

Compliance:

The form helps users comply with tax laws and regulations, ensuring they meet the requirements for claiming itemized deductions.

Peace of Mind:

The form provides users with peace of mind, knowing that they have accurately tracked and also claimed their deductions, and are in compliance with tax laws and regulations.