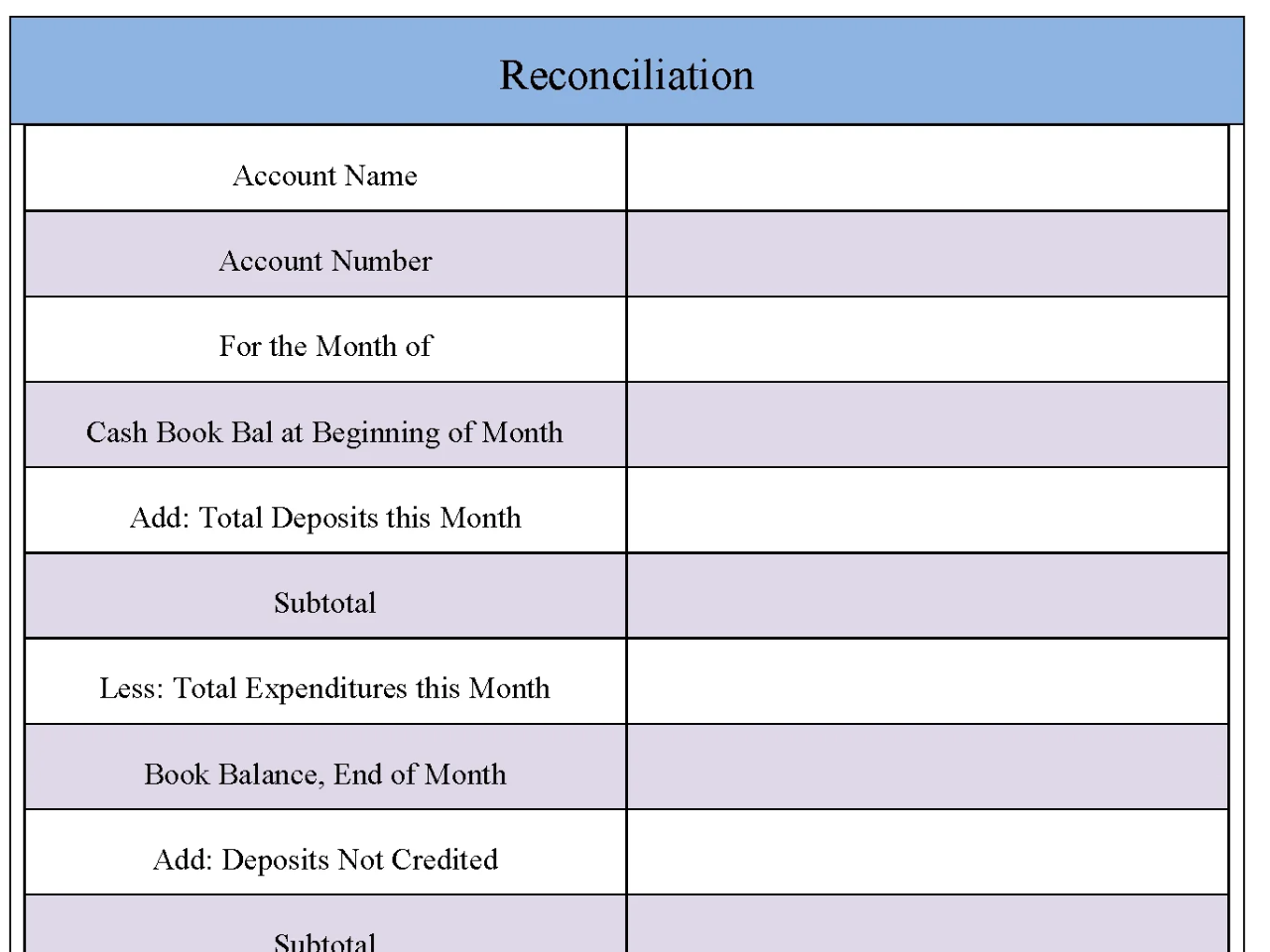

The reconciliation form allows individuals to compare their personal bank account records to the bank’s records of the individual’s account balance in order to uncover any possible discrepancies. It is used by customers who hold accounts with banks to ensure that the banks records coincide with the information that they have about their accounts and the transactions passing through the accounts. Most banks provide these forms to their customers to ensure that their clients are satisfied with the status and transactions made through their accounts. Below is a sample reconciliation form.

You can Download the Reconciliation Form post; customize it according to your needs and Print. Reconciliation Form is either in MS Word and Editable PDF.

Download Reconciliation Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Detailed Transaction Tracking

Allows users to record, track, and also verify all transactions, ensuring accuracy in financial records.

Automated Calculations

Includes functions for auto-calculating totals and also balances, reducing manual errors and also speeding up reconciliation.

Customizable Fields

Enables customization of fields to fit specific transaction types, account structures, or business requirements.

Audit Trail

Maintains a history of changes, making it easy to track adjustments and also understand discrepancies.

Integration with Accounting Software

Can integrate with popular accounting software for seamless data transfer and also reconciliation.

Printable and Shareable Format

Designed for easy printing and also sharing with relevant stakeholders for review or audit purposes.

Benefits:

Increased Accuracy

Helps minimize errors by systematically verifying transactions, leading to more accurate financial records.

Time Efficiency

Speeds up the reconciliation process, allowing users to identify discrepancies quickly and also efficiently.

Enhanced Financial Control

Improves financial oversight by providing a clear view of all transactions, enabling better financial decision-making.

Improved Compliance

Helps businesses stay compliant with financial regulations by ensuring all accounts are regularly and also accurately reconciled.

Reduced Risk of Fraud

Provides a structured method for checking and verifying transactions, reducing the chance of fraud or unauthorized entries.

Streamlined Audits

Simplifies audits by providing organized and also reconciled records, making it easier for auditors to review financial data.