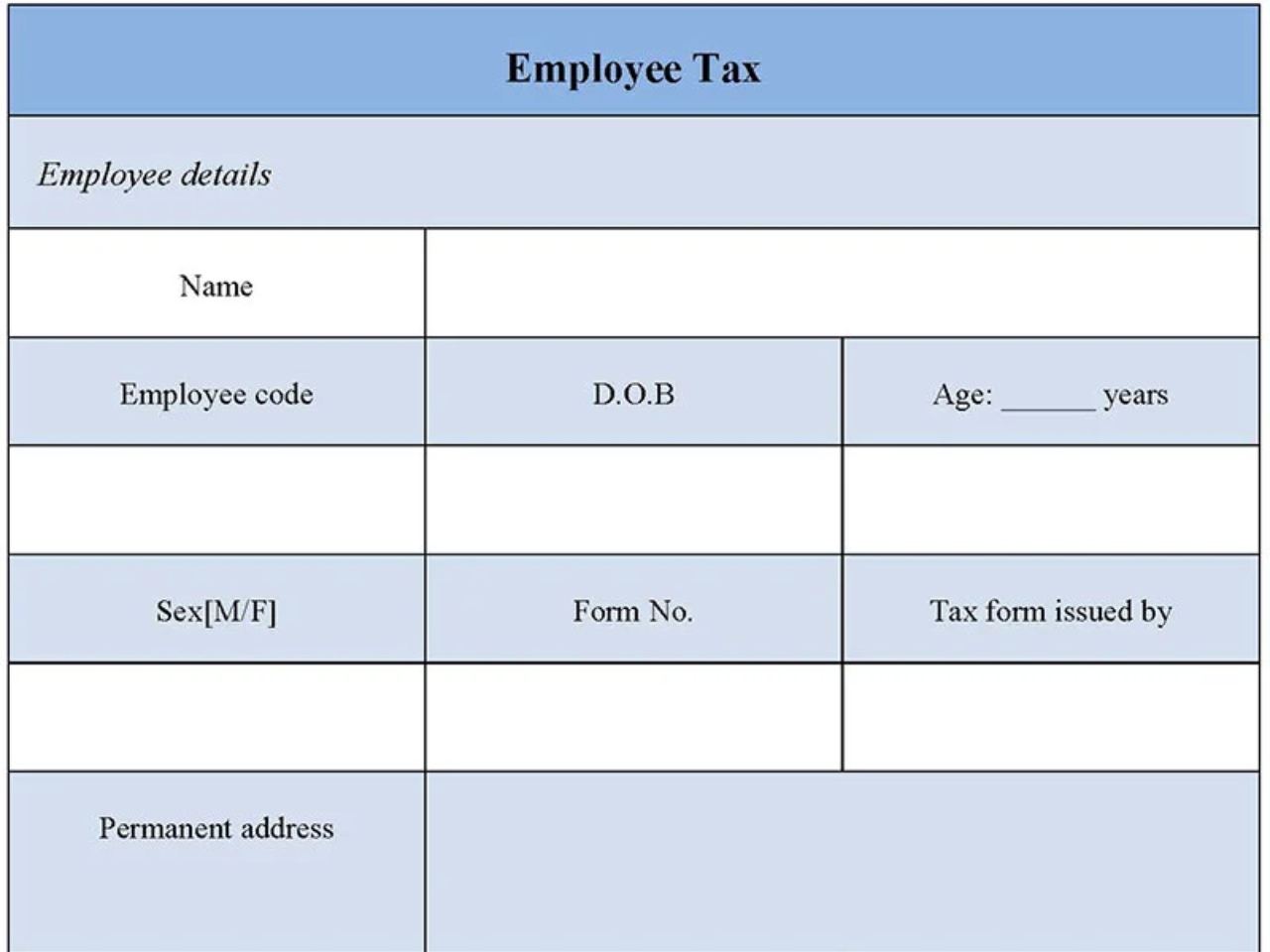

An employee tax form is a tax form prepared especially for employees and for calculating employee tax returns. The structure of an employee tax form would have to be such that it contains the general particulars of the tax payment methods and specificities of employee taxes as well. The form should have individual sections of incorporating information such as name of employee, position held in the company or firm, nature of work, age, sex, salary, bonus, and also such other income details and also company procedures. These tax forms are issued by the respective company in the name of the employee and the returns are calculated as per the company conditions.

You can Download the Employee Tax Form post; customize it according to your needs and Print. Employee Tax Form is either in MS Word and Editable PDF.

Download Employee Tax Form for only $6.54

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and exact name of the form you purchased and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

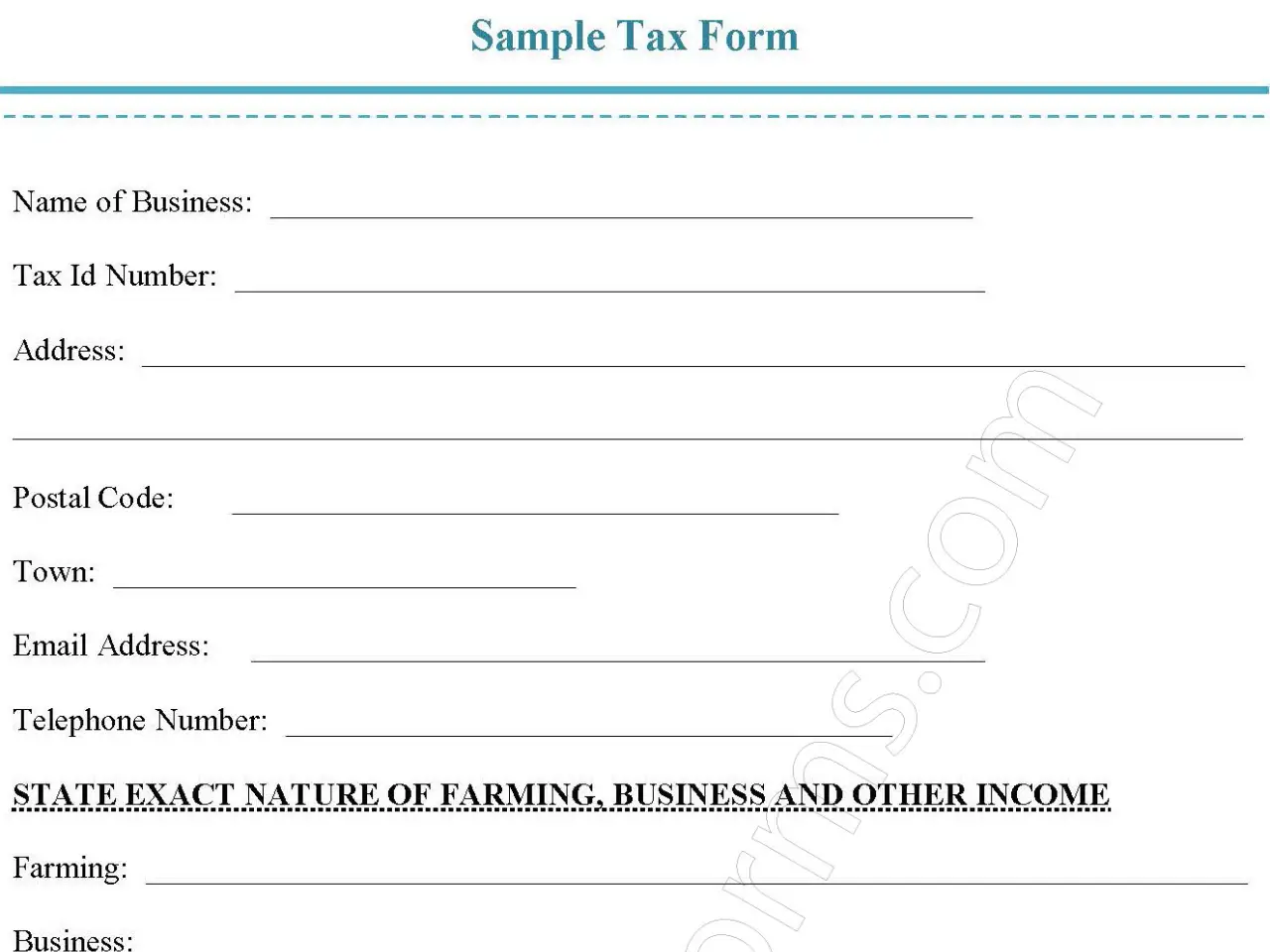

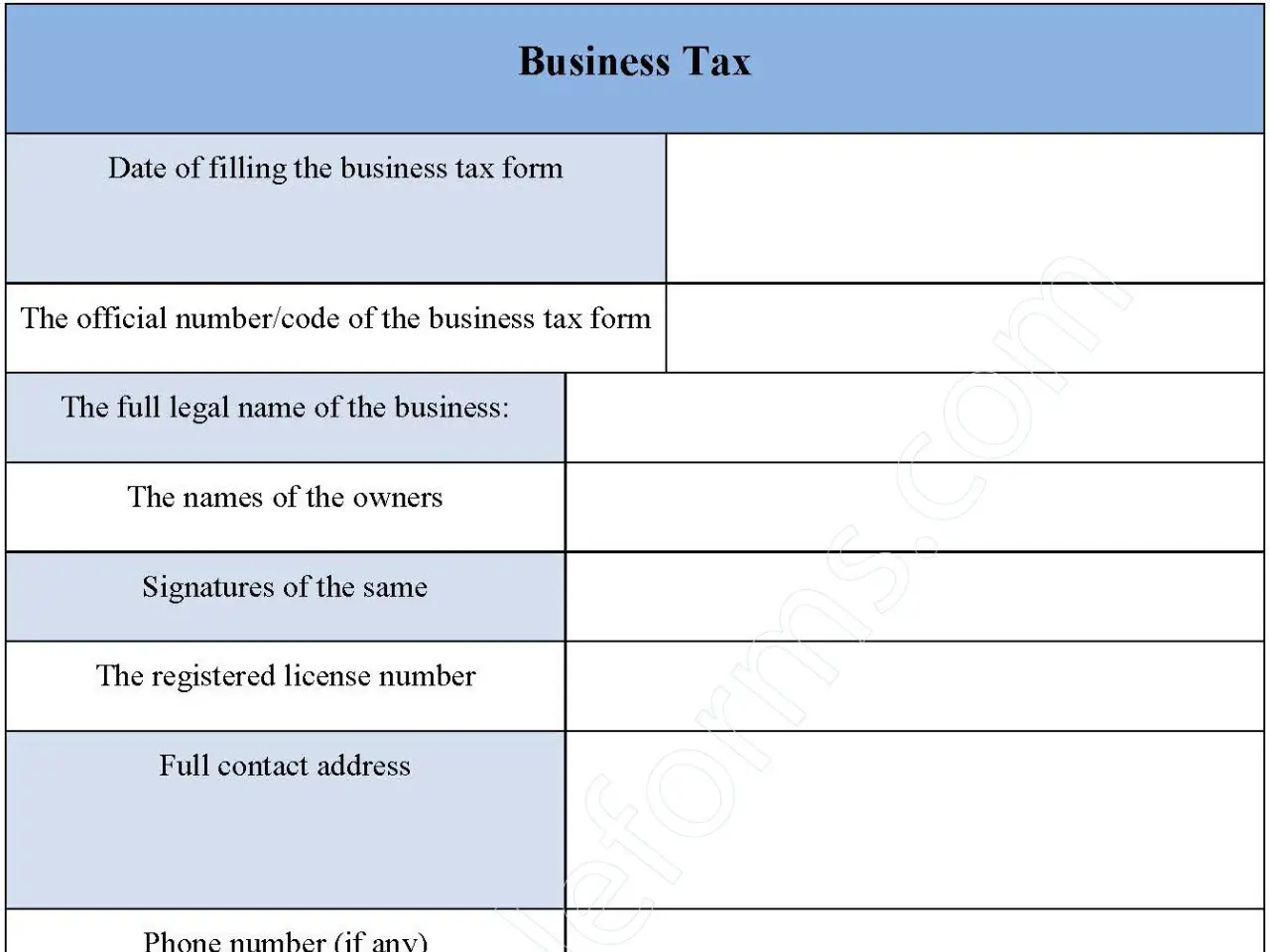

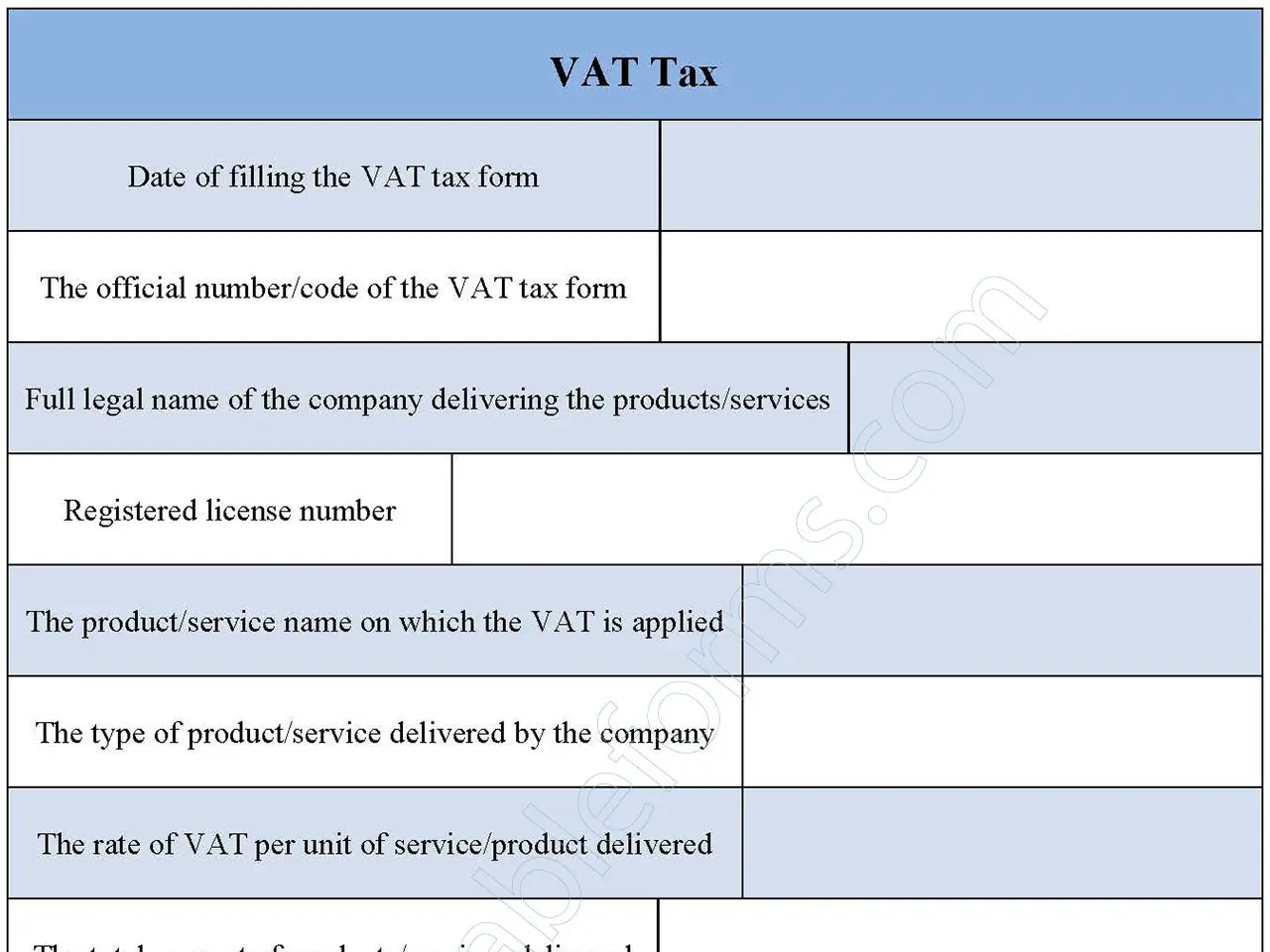

Personal and Employment Information:

Captures employee details, including name, address, tax identification number, and also employment status.

Tax Withholding Instructions:

Allows employees to specify their withholding preferences, including allowances and also additional withholdings.

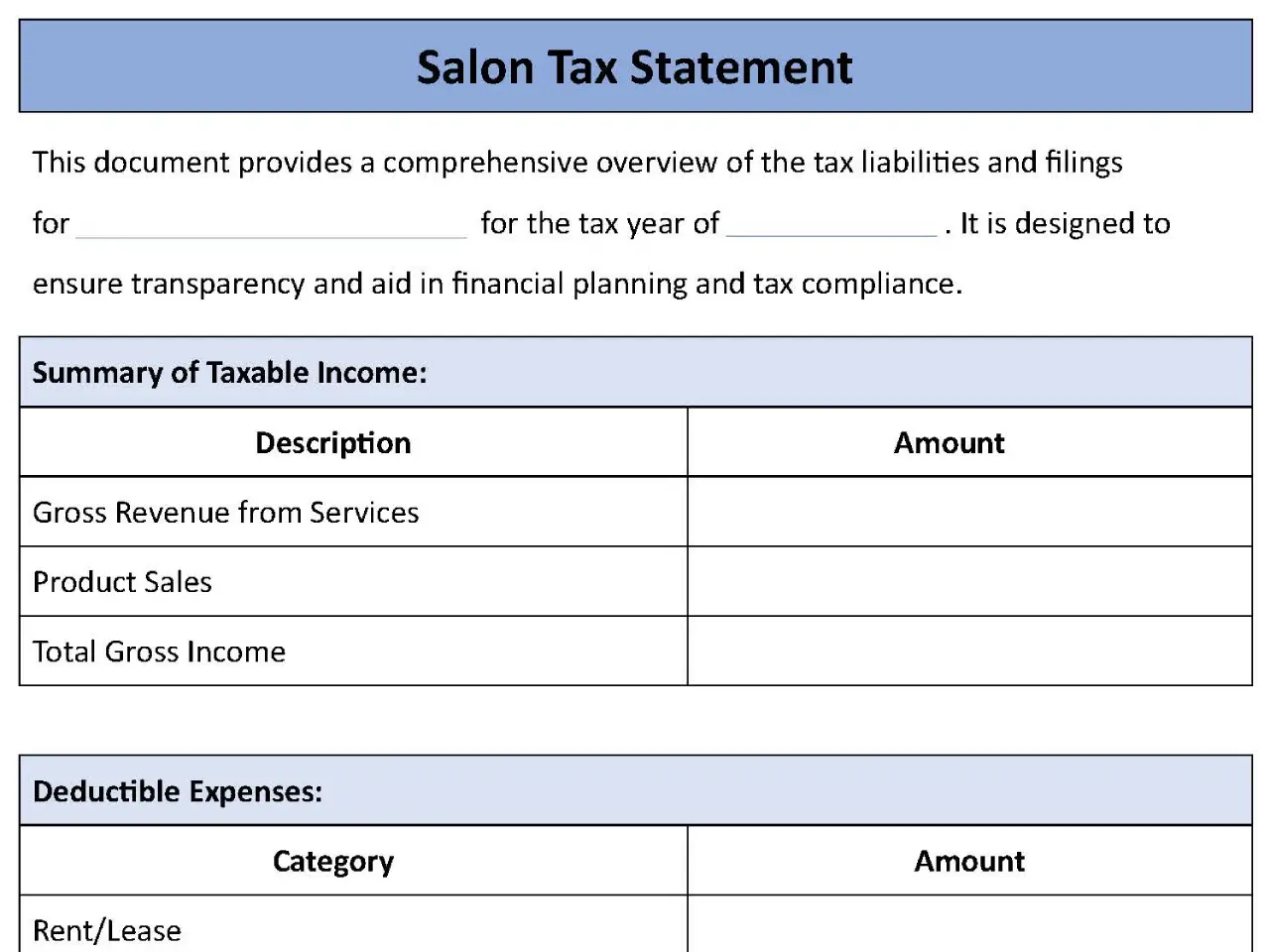

Income Reporting:

Includes sections for reporting wages, bonuses, and also other taxable income.

Tax Credits and Deductions:

Provides fields for eligible tax credits and deductions, such as dependents, education credits, and also retirement contributions.

Electronic Filing and Submission:

Supports online submission, ensuring faster processing and also easier record management.

Benefits:

Accurate Tax Withholding:

Helps ensure that employees have the correct amount of tax withheld from their paychecks, avoiding underpayment or overpayment.

Streamlined Tax Filing:

Simplifies the process of filing taxes by providing a clear and also organized format for reporting income and also deductions.

Faster Processing and Refunds:

Enables digital submission, speeding up the tax filing process and also potentially accelerating refunds.

Ensures Compliance:

Helps employees meet tax obligations by adhering to relevant tax laws and also regulations, minimizing audit risks.

Increases Financial Clarity:

Provides employees with a clear understanding of their taxable income and also potential deductions, helping them plan for taxes effectively.