Chapter 13 bankruptcy form is a type of bankruptcy that allows individuals to repay their debts throughout 3 to 5 years. This type of bankruptcy can be a good option for people with a steady income who can afford to make monthly payments to their creditors.

To file and, complete the PDF Form and file it with the bankruptcy court. The form is available for free on the website of the United States Courts.

The Chapter 13 Bankruptcy PDF is complex, but it is essential to complete it accurately and completely. If you have any questions about the form, consult an attorney.

Download the Chapter 13 Bankruptcy Template, customize it according to your needs, and Print it. Chapter 13 Bankruptcy Form Template is either in MS Word or Editable PDF.

Download the Chapter 13 Bankruptcy Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

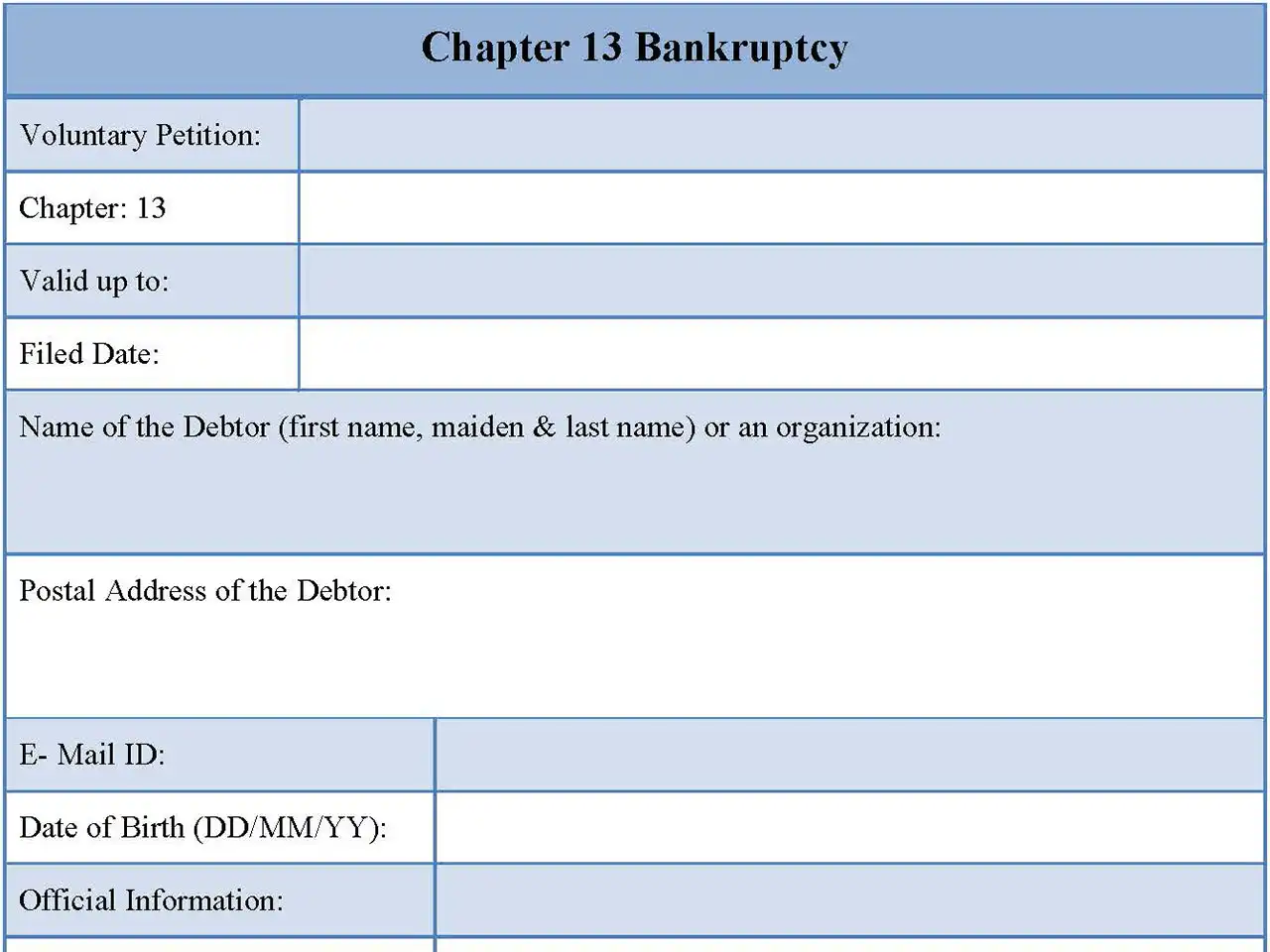

Here is a step-by-step guide on how to complete the Chapter 13 Bankruptcy Fillable PDF Template:

- Download the form. The Chapter 13 Bankruptcy Fillable PDF Form is free on the United States Courts website.

- Gather your information. Before you start filling out the form, you must gather information, such as your income, expenses, debts, and assets.

- Complete the form. The form is divided into several sections, including:

- Debtor information: This section includes information about you, such as your name, address, and Social Security number.

- Income information: This section includes information about your income, such as your job, salary, and other sources of income.

- Expense information: This section includes information about your expenses, such as your housing costs, utilities, and transportation costs.

- Debt information: This section includes information about your debts, such as the type of debt, the amount of debt, and the name of the creditor.

- Asset information: This section includes information about your assets, such as your home, car, and bank accounts.

- Sign and file the form. Once you have completed the form, you must sign and file it with the bankruptcy court. You can file the form electronically or in person.

A bankruptcy trustee will be appointed to your case once you have filed the Chapter 13 Bankruptcy Fillable PDF Form. The trustee will review your finances and create a repayment plan. The repayment plan will specify how much you must pay to your creditors each month.

If you can complete the repayment plan, you will receive a discharge of your debts. This means you will no longer be legally obligated to repay your debts.

Benefits of Filing for Chapter 13 Bankruptcy Template

There are several benefits to filing for Chapter 13 bankruptcy, including:

- You can repay your debts throughout 3 to 5 years. This can give you more time to get back on your feet financially.

- You can stop foreclosure on your home and repossession of your car.

- You can reduce or eliminate unsecured debts, such as credit card and medical debt.

- You can get a discharge of your debts at the end of the repayment plan.

- Drawbacks of Filing for Chapter 13 Bankruptcy

There are also some drawbacks to filing for Chapter 13 bankruptcy, including:

- You must make regular payments to your creditors. If you fail to make a payment, your case could be dismissed.

- You may not be able to discharge all of your debts. Some types of debt, such as student loans and child support, cannot be discharged in bankruptcy.

- Bankruptcy can damage your credit score. It can take several years to rebuild your credit after filing for bankruptcy.

Conclusion

Chapter 13 bankruptcy can be a good option for people with a steady income and who can afford to make monthly payments to their creditors. If you are considering filing for Chapter 13 bankruptcy, you should consult with an attorney to discuss your options and to get help completing the Chapter 13 Bankruptcy Fillable PDF Form.