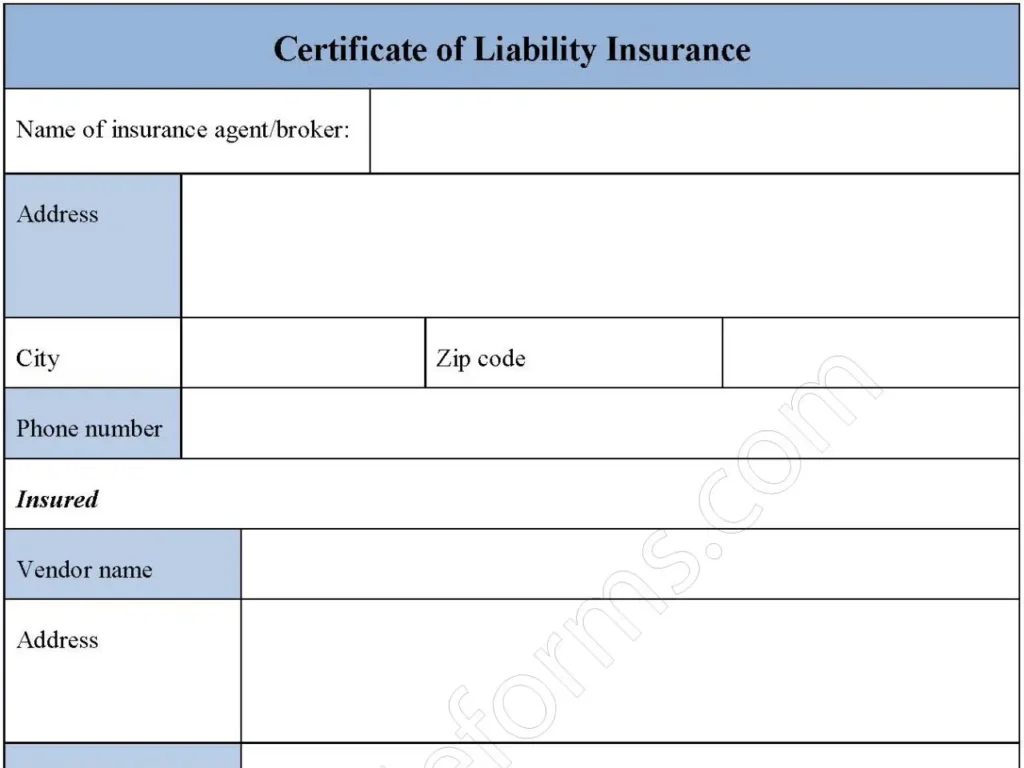

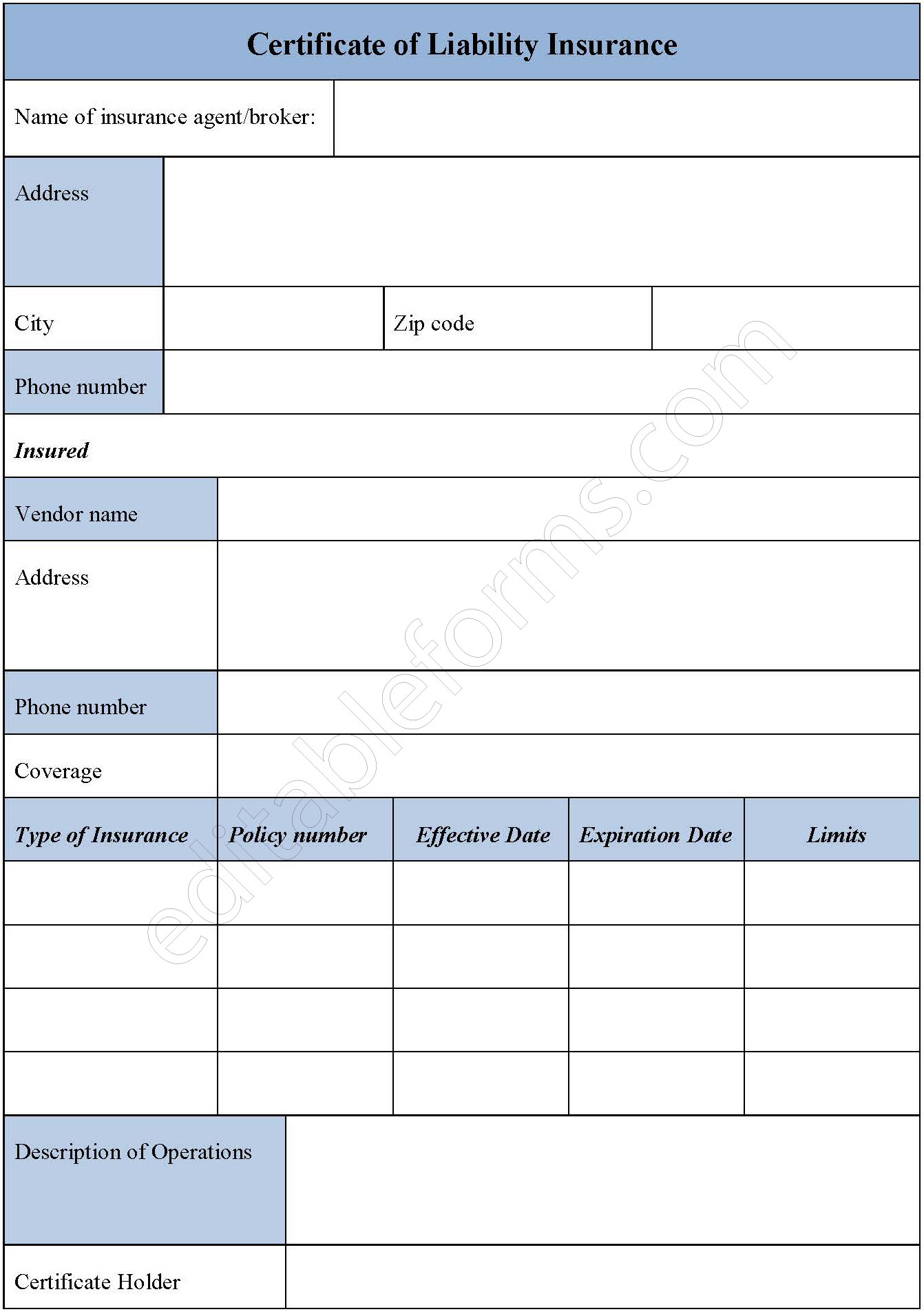

A certificate of liability insurance popularly acts as evidence of one party’s insurance. It offers protection to the party as well as the business partners in case of any losses incurred. However, the form does not provide the actual benefit of insurance to the party involved. Below is a sample certificate of liability insurance form.

You can Download the Certificate of Liability Insurance Form, customize it according to your needs, and Print it. The certificate of Liability Insurance Form Template is either in MS Word or Editable PDF.

Download the Certificate of Liability Insurance Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Features:

Policy Information:

The certificate identifies the insurance company issuing the certificate, the policyholder (the entity that purchased the insurance), and the policy number.

Coverage Details:

The certificate may outline brief details of the coverage provided by the policy, such as the types of liability covered (e.g., general liability, professional liability) and policy limits (the maximum amount the insurance company will pay for a covered claim).

Effective Dates:

The certificate displays the dates during which the liability insurance policy is in effect.

Additional Insured:

The certificate may list any additional insureds covered by the policy, other than the policyholder. This can sometimes be required by a contractual agreement between two parties.

Benefits:

Proof of Insurance:

The certificate serves as proof of liability insurance for the policyholder. This can be required by businesses, landlords, event organizers, or others to demonstrate financial protection in case of accidents or injuries arising from the policyholder’s activities.

Contractual Requirement:

In some cases, a certificate of liability insurance may be required by a contract between two parties. For example, a venue hosting an event may require proof of liability insurance from the event organizer.

Peace of Mind:

Having liability insurance and providing proof of coverage can give policyholders peace of mind knowing they have financial protection against covered liability claims.