Creditors use a credit application form to gather information from credit recipients. As the recipient, you are required to disclose information about your company to your potential creditors.

Trade references will be looked up; therefore, be sure to put down only names of referees you are sure will give you good relations.

Download the Credit Application Form, customize it to your needs, and Print it. Credit Application Form Template is either in MS Word or Editable PDF.

Download the Credit Application Form for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Features

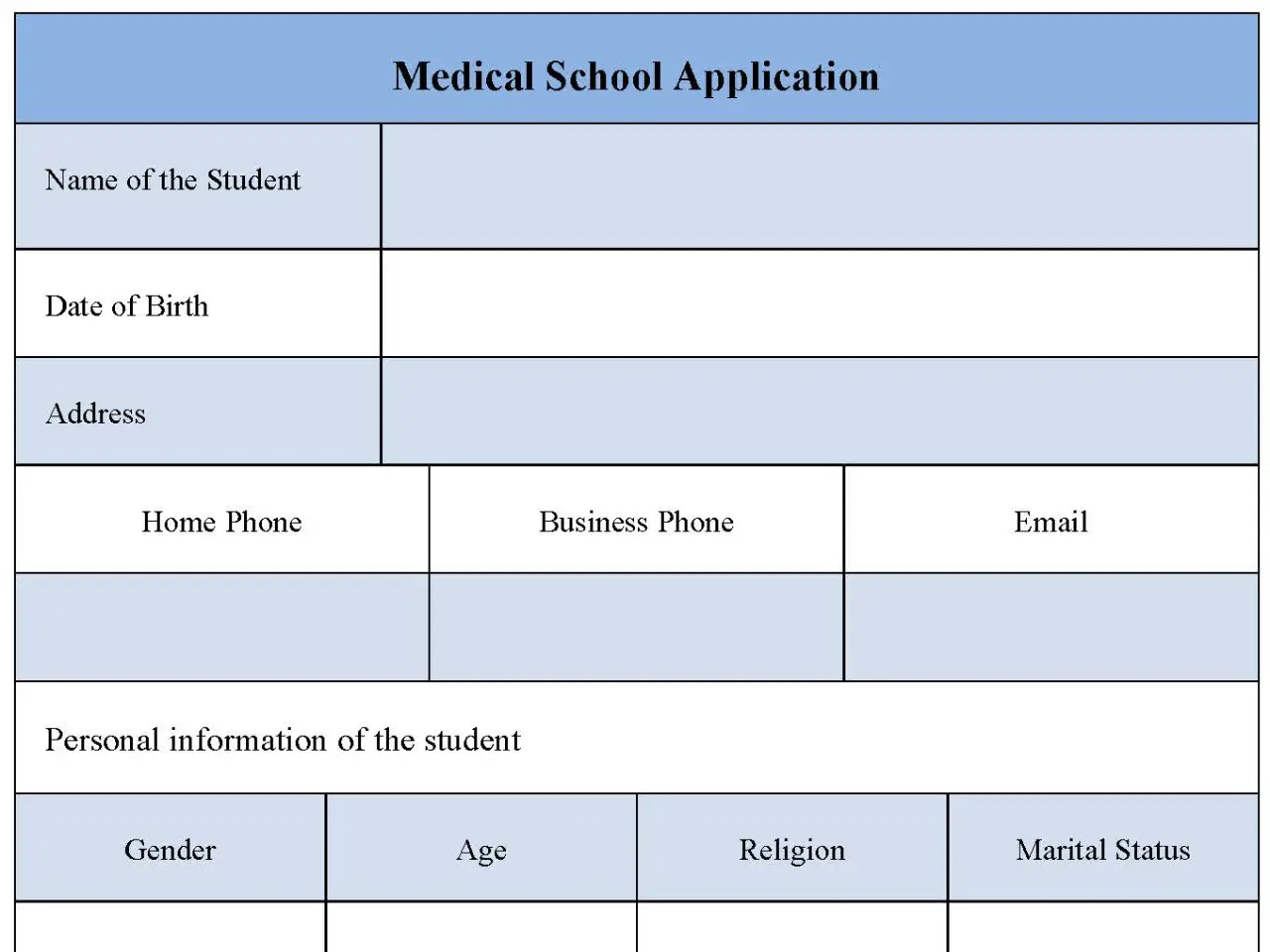

Company Information:

Business name and trading name (if applicable)

Business address, phone number, and fax number (if applicable)

Date the business was founded

Tax identification number

Estimated annual sales

How long the business has traded at its current address

Bank Information:

Name of the bank

Branch name

Contact person at the bank

Bank phone number

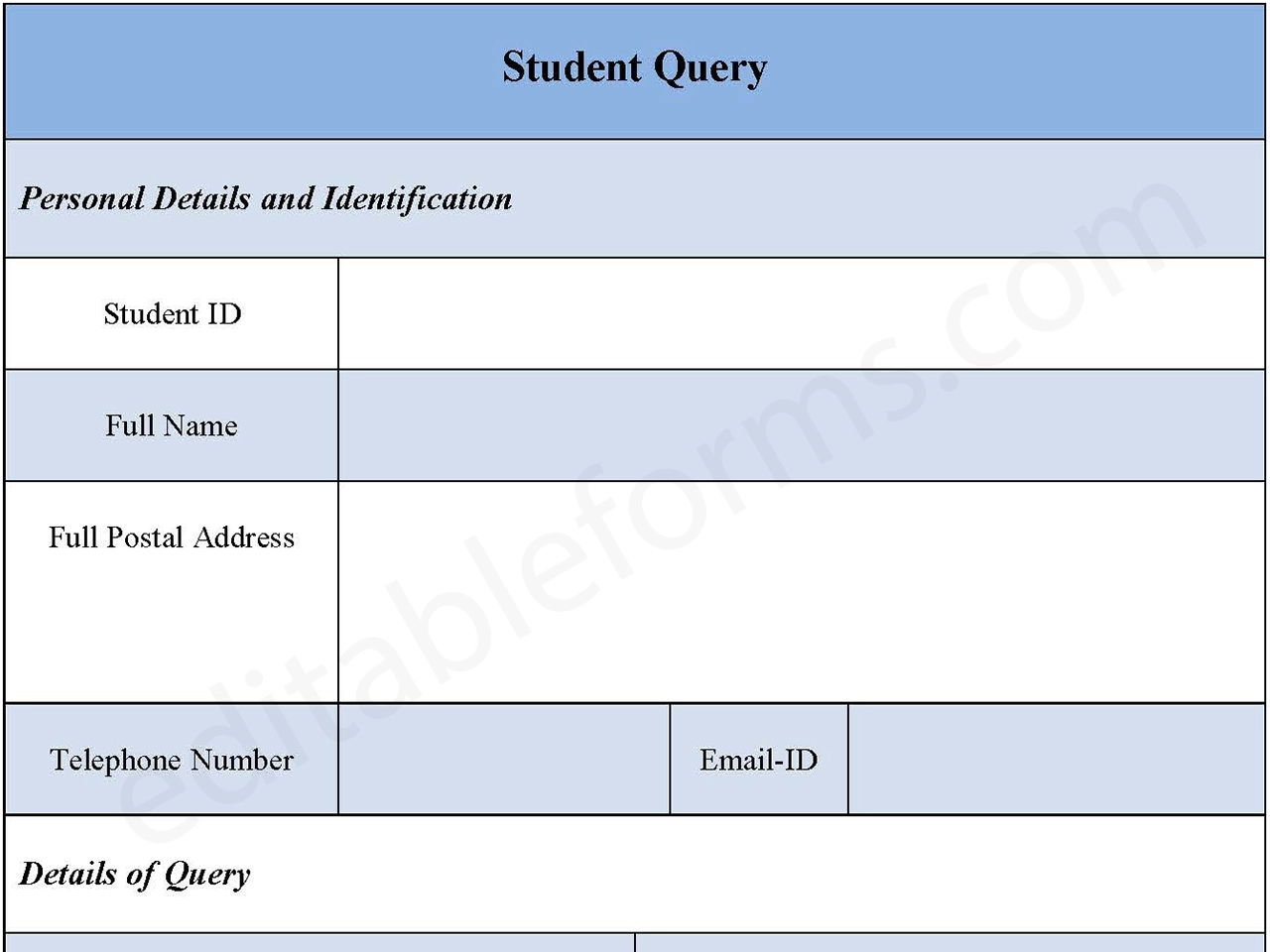

Trade References:

Names and contact information of previous creditors or suppliers the business has credit with

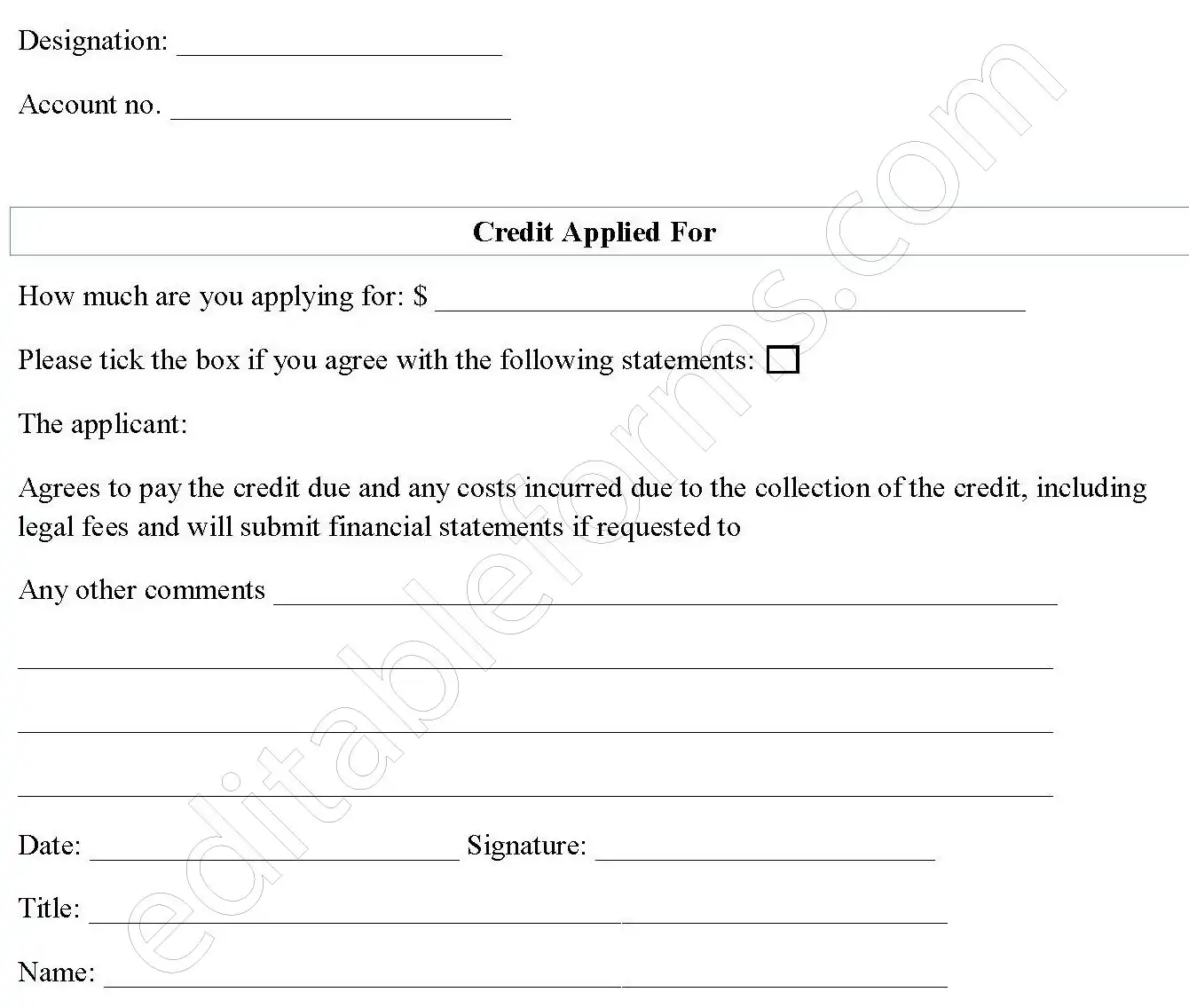

Authorization:

A section for the applicant to sign and also authorize a credit check

Benefits

Standardized application process:

A credit application template ensures all potential customers are submitting the same information in a consistent format. This allows businesses to easily compare applicants and also make informed lending decisions.

Complete information gathering:

The template ensures all the essential information required to assess a company’s creditworthiness is collected.

Business information (name, address, tax ID number)

Financial information (estimated annual sales, bank information)

Trade references (references from previous creditors)

Reduced risk of bad debt:

By carefully assessing a company’s creditworthiness through the information gathered in the application, businesses can also reduce the risk of bad debt and also loan defaults.