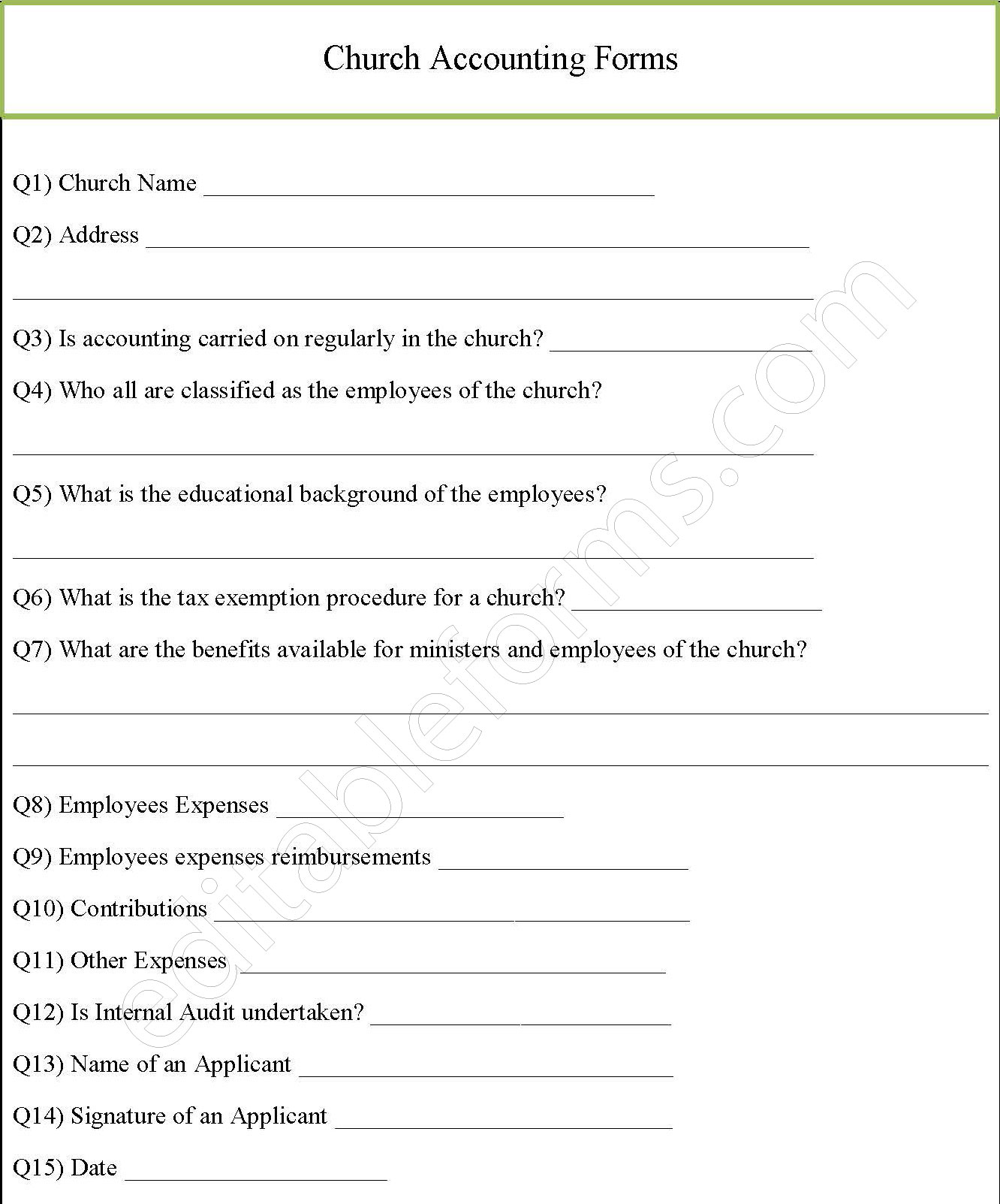

Church accounting forms are used to keep the track of the expenses that are incurred by the churches. Though Church accounting is one of the parts of Non-Profit accounting but complete details regarding the income and the expenses are to be maintained by them and thus these forms are prepared for the same.

You can Download the Church Accounting Forms, customize it according to your needs and Print. Church Accounting Forms Template is either in MS Word and Editable PDF.

Download the Church Accounting Forms for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, please Contact Us and include your receipt number and the exact name of the form you purchased, and I’ll email you a copy.

Absolutely! We offer complimentary editing services for any purchased forms to ensure they meet your specific needs. If you require a brand new form, our team can design one tailored to your specifications at an affordable price.

Features:

Donation Tracking:

Includes fields for recording individual contributions, donations, and also offerings, with donor details and also dates for transparency.

Expense Recording:

Provides sections to document all church-related expenses, including utilities, events, charity, and also operational costs.

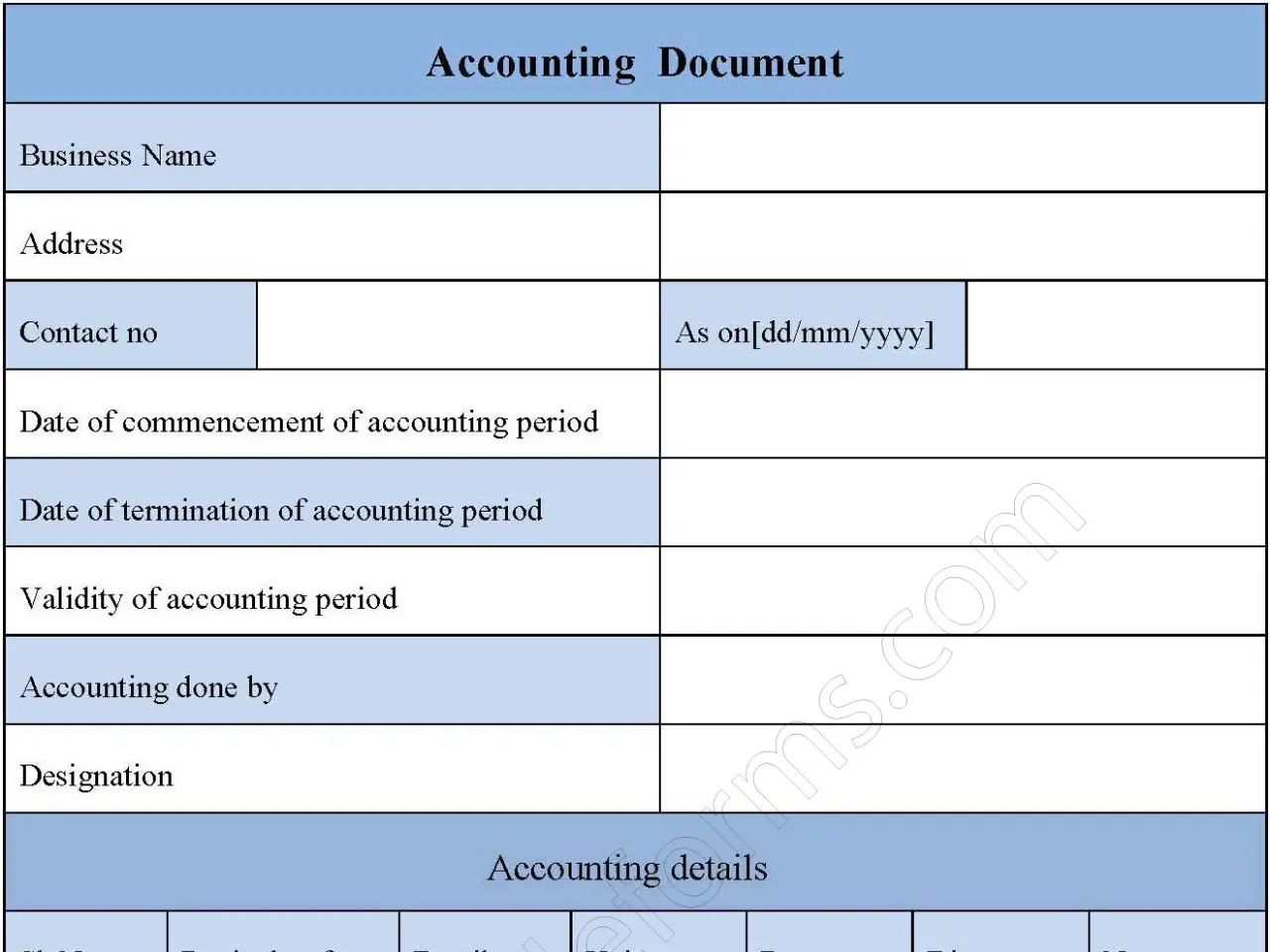

Fund Allocation:

Allows for designating funds for specific purposes (e.g., outreach, missions, building maintenance), aiding in budget management.

Income and Expense Statements:

Provides pre-formatted templates to prepare regular financial statements, summarizing income versus expenditures.

Payroll Documentation:

Includes fields to record payroll and also stipends for church staff, ensuring accurate compensation tracking.

Budgeting Tools:

Incorporates budgeting forms to help track monthly and yearly budgets, compare actual versus planned spending, and also manage church finances.

Year-End Summary Reports:

Offers a structured template for creating year-end financial summaries, essential for annual reporting and also audits.

Tax Receipt Generation:

Provides templates to generate tax receipts for donors, ensuring they receive proper documentation for tax-deductible contributions.

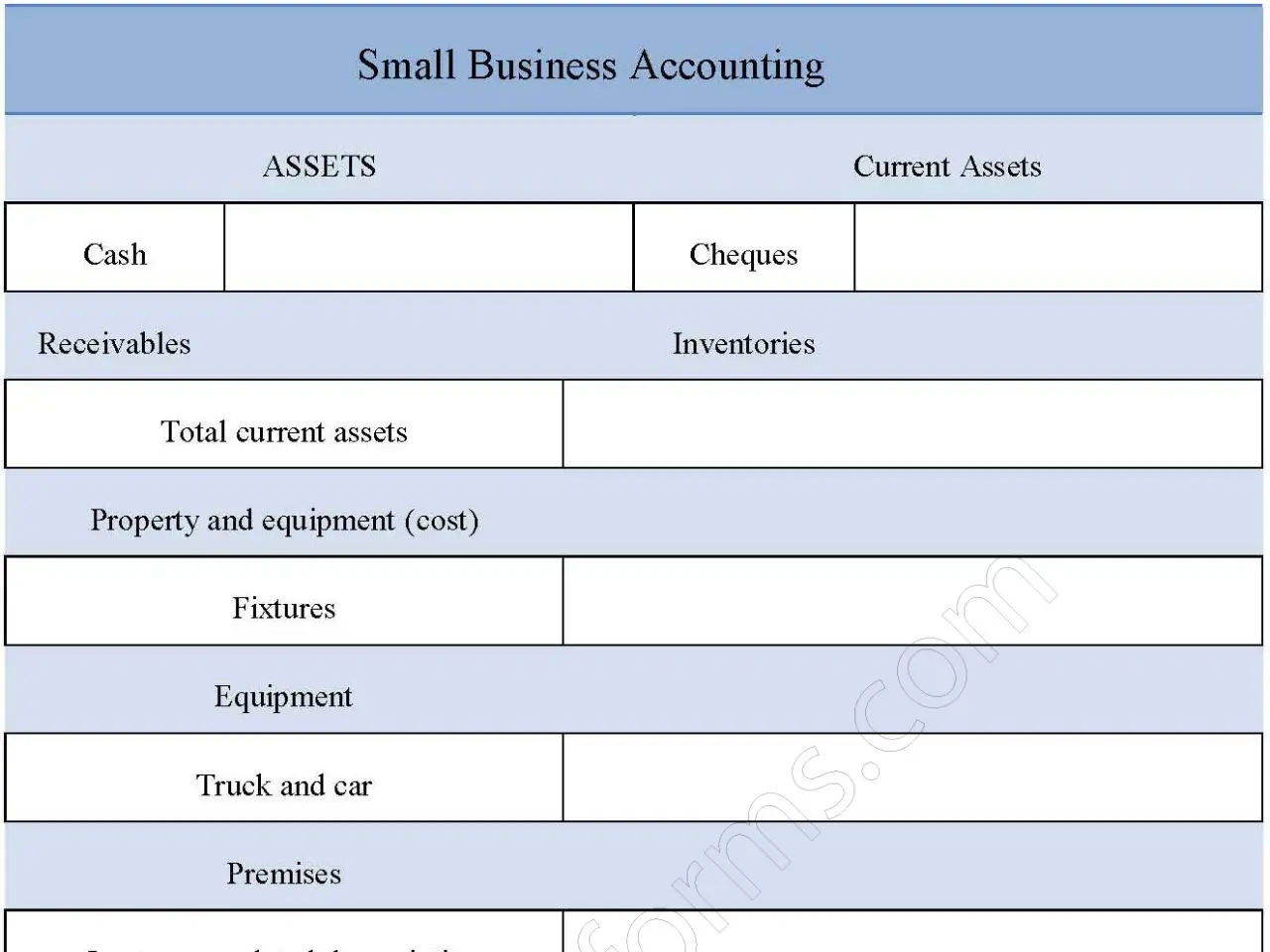

Benefits:

Financial Transparency:

Enhances trust among congregation members by providing a transparent record of how funds are received, allocated, and also spent.

Compliance with Legal Requirements:

Helps churches maintain accurate records required by tax authorities and also ensure compliance with charitable organization regulations.

Efficient Donation Management:

Simplifies the tracking and reporting of donations, helping churches acknowledge contributions promptly and also accurately.

Improved Budget Oversight:

Allows church leaders to monitor spending against the budget, aiding in better financial stewardship and also fund allocation.

Simplified Year-End Reporting:

Streamlines the creation of year-end reports, reducing time and also effort needed to prepare for financial reviews or audits.

Accountability to Stakeholders:

Builds accountability to members and also donors by offering a clear breakdown of income and also expenses, fostering a sense of community trust.

Enhanced Decision-Making:

Provides leaders with a comprehensive financial overview, supporting better decisions regarding future projects and also spending priorities.

Supports Audit and Review Processes:

Facilitates regular audits by offering well-organized, complete records, ensuring the church meets legal and also ethical standards.