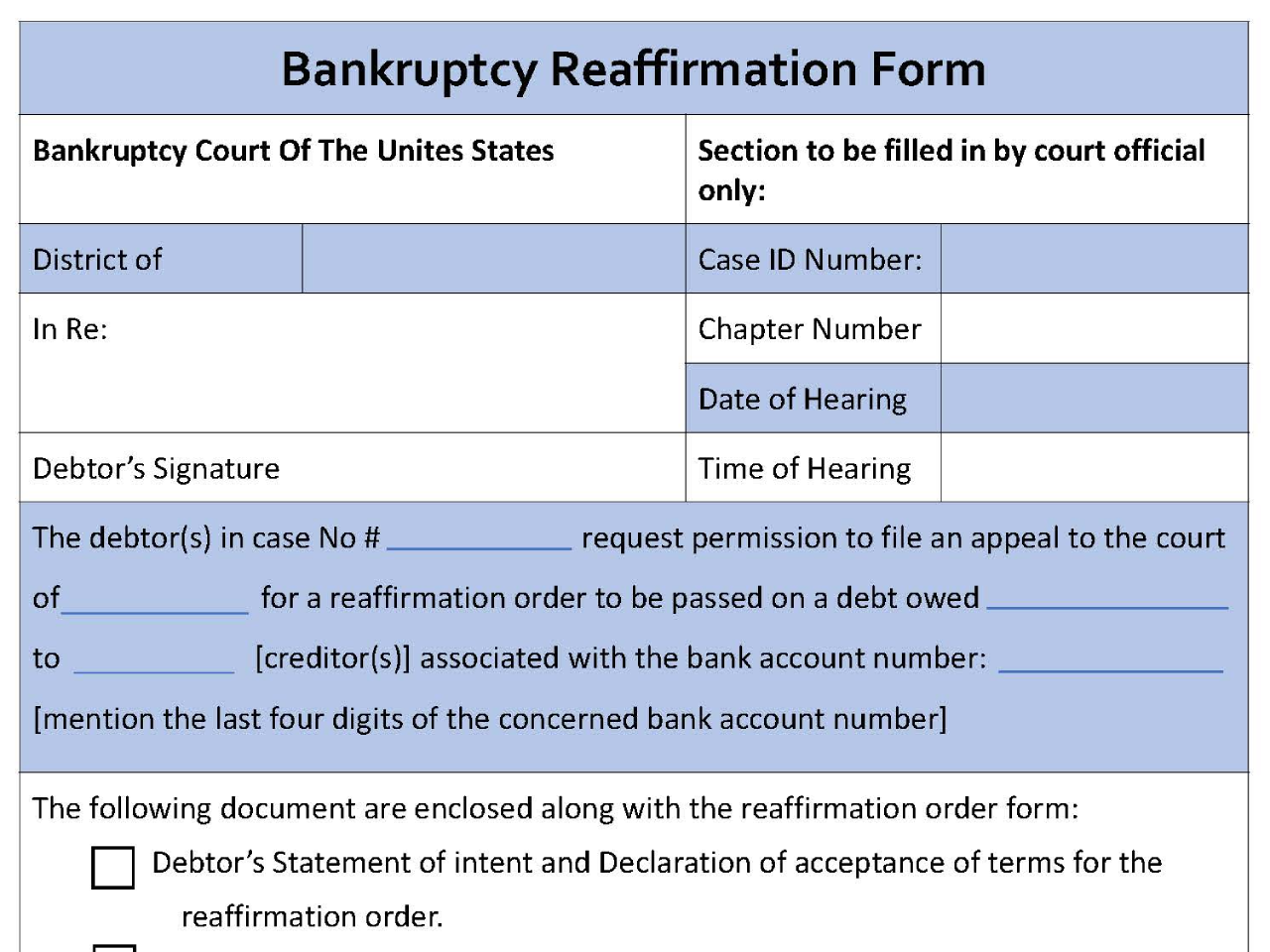

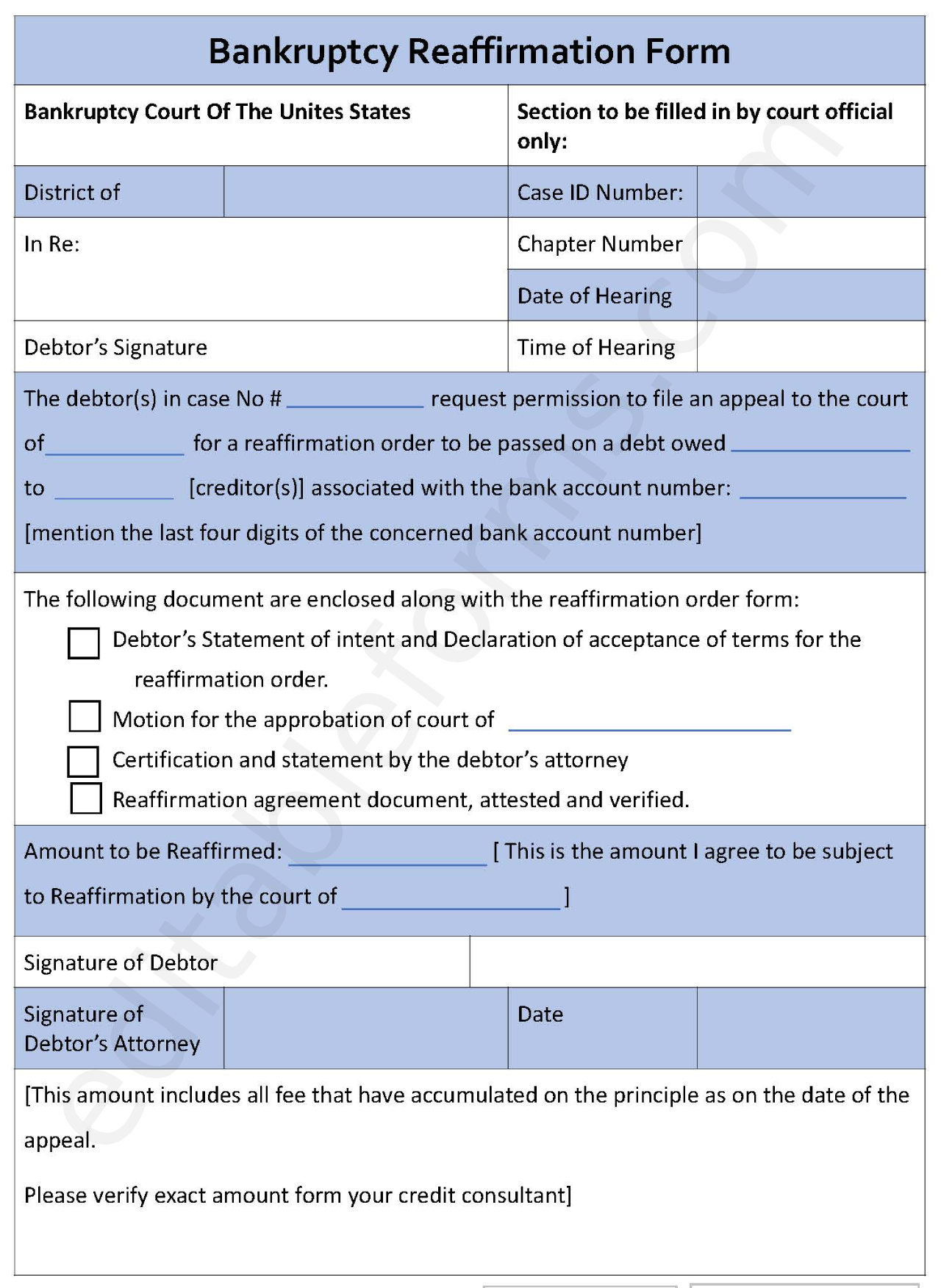

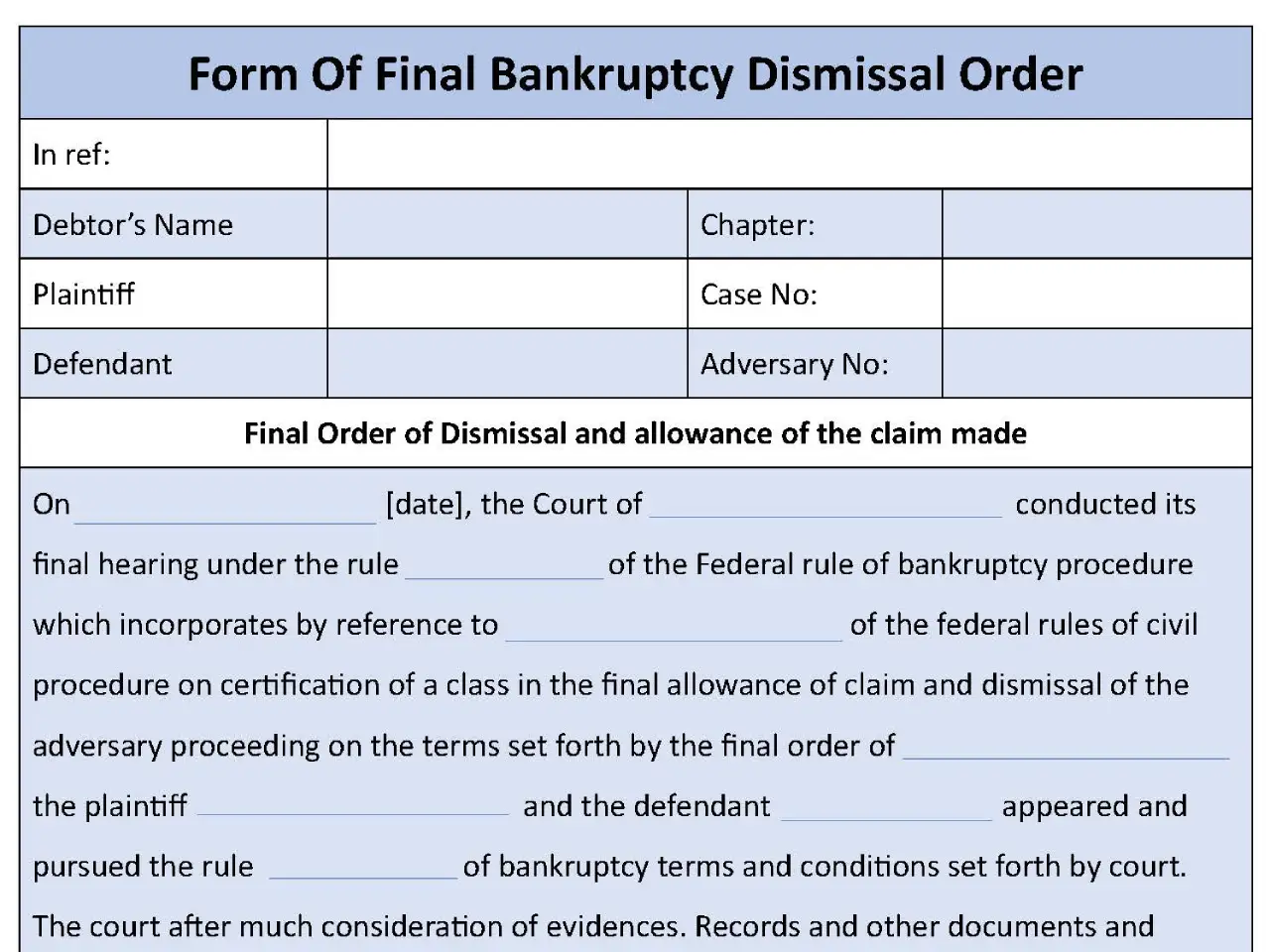

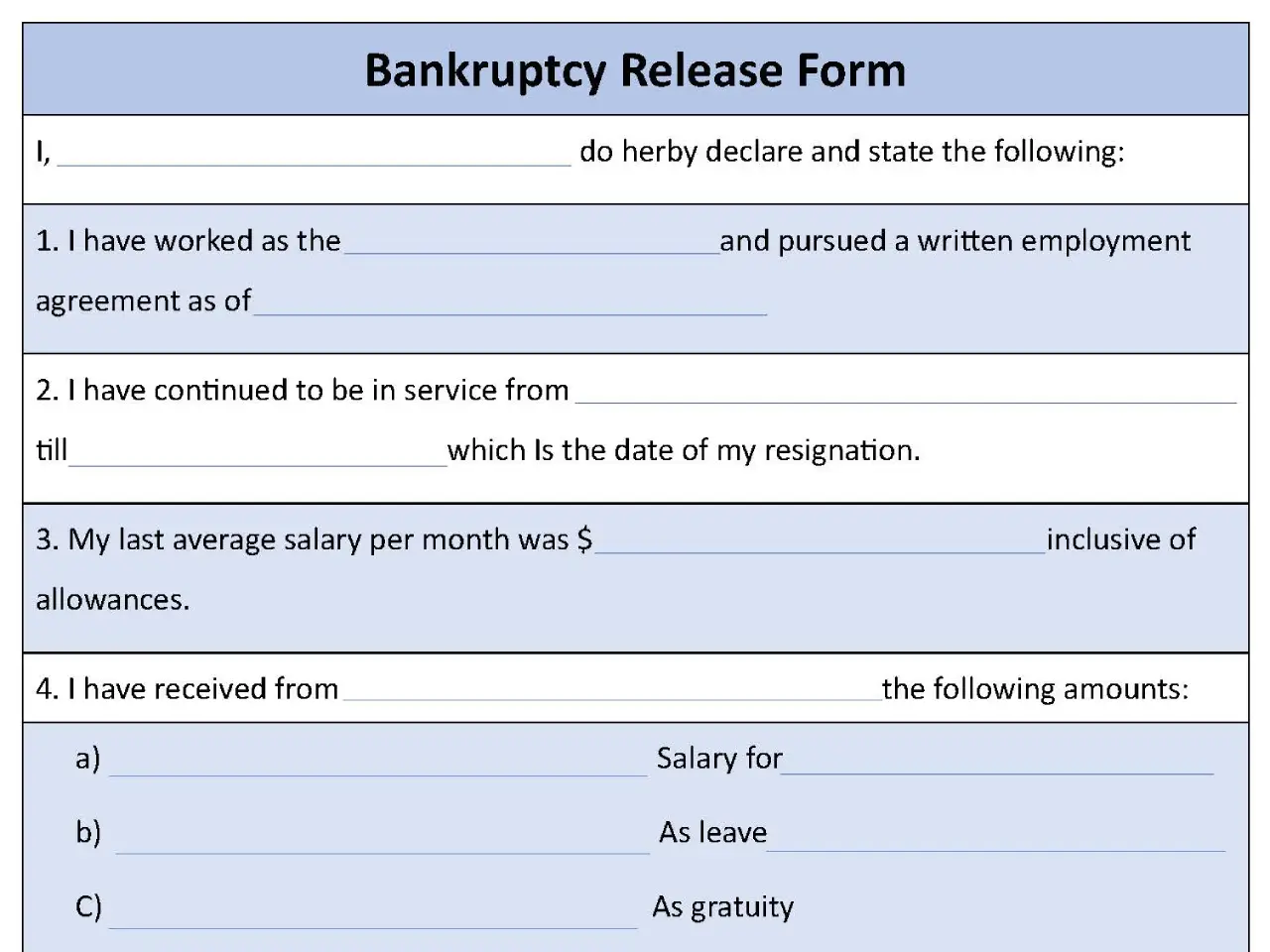

A bankruptcy reaffirmation form is a document which is pre-printed and issued by the Bankruptcy Court of a district to a debtor, in order to keep certain debts and liabilities beyond the bankruptcy discharge which shall be negotiated by the court and the debtor’s attorney. It has to be filled in by the debtor outlining his needs, financial details and so on.

You can Download the Bankruptcy Reaffirmation Template, customize it according to your needs, and Print it. Bankruptcy Reaffirmation Template is either in MS Word or Editable PDF.

Download the Bankruptcy Reaffirmation Form Template for only $6.54.

Buy Now: 6.54 USDIf you are having problems downloading a purchased form, don’t hesitate to contact us and include your receipt number and the exact name of the document you purchased, and I’ll email you a copy.

Features:

Debtor and Creditor Information:

Clearly identifies the debtor filing for bankruptcy and the creditor they owe the debt to (e.g., credit card company, auto loan lender).

Description of Debt:

Specifies the type and amount of debt being reaffirmed (e.g., credit card balance, remaining auto loan balance).

Original Agreement Reference:

May reference the original credit agreement or loan contract containing the terms of the debt.

Waiver of Discharge:

The debtor waives their right to have the specific debt discharged in the bankruptcy proceeding.

Signatures:

Designated sections for the debtor, creditor, and potentially the debtor’s attorney to sign and date the agreement.

Benefits:

Preserves Valuable Assets:

By reaffirming a debt, a debtor can keep collateralized property (e.g., a car financed through a loan) that might otherwise be repossessed during bankruptcy.

Maintains Credit Standing:

Reaffirming a debt on a credit card or other loan can potentially help the debtor avoid a complete decline in their credit score.

Rebuilds Trust with Creditors:

Fulfilling a reaffirmed debt obligation demonstrates the debtor’s commitment to repaying creditors, potentially improving their chances of obtaining new credit in the future.